Advertisement

Advertisement

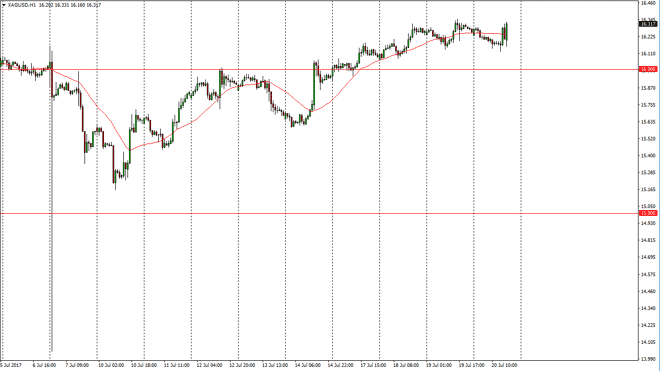

Silver Price Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:28 GMT+00:00

The Silver markets fell slightly during the session on Thursday, but found enough support near the $16.15 level to turn around and rally. We have seen a

The Silver markets fell slightly during the session on Thursday, but found enough support near the $16.15 level to turn around and rally. We have seen a lot of volatility since then, due to an announcement of expanded investigations into Donald Trump’s companies, but at the end of the day the investigators have not suggested that they have found anything, just that they are looking into his global companies as well. Because of this, we have seen a bit of an overreaction in the markets around the world, but as things calm down it looks like we are going to simply grind higher as we have been for some time. The $16.15 level above should be resistance, as it is a large, round, psychologically significant number. I believe that pullbacks will probably find plenty of support near the $16.00 level, as there are more than enough buyers underneath.

Buying the dips

I continue to buy the dips in the silver market, but I would do it in a slow and methodical way. I believe that physical silver is a great way to play this market, but if you can do that perhaps you can consider an ETF such as the SLV, or even small CFD positions. I don’t like the idea of high leverage in the silver market for a couple of reasons, not the least of which is that the volatility could cause massive swings in your account balance. Beyond that, you could end up tying up quite a bit of margin trying to wait out the trade and send the market towards the $17 level above. Longer-term, I would not be surprised at all to see the silver market reach towards $20, but a lot of this will depend on what the Federal Reserve does as people are starting to question whether they can raise interest rates.

SILVER Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement