Advertisement

Advertisement

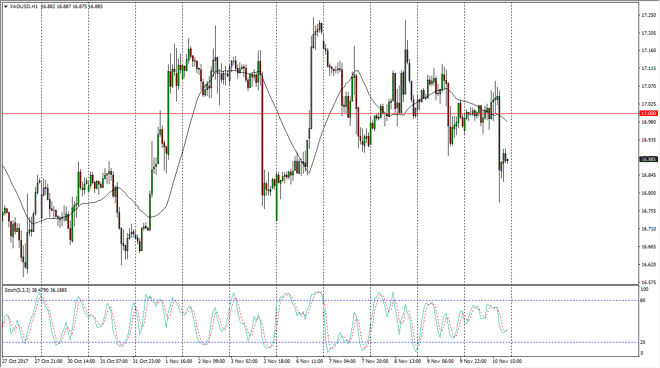

Silver Price Forecast November 13, 2017, Technical Analysis

Updated: Jan 23, 2018, 08:55 GMT+00:00

Silver markets went sideways during most of the session on Friday, but then sliced through the $17 level rather handily. However, I think that the market

Silver markets went sideways during most of the session on Friday, but then sliced through the $17 level rather handily. However, I think that the market has plenty of support underneath, especially near the $16.75 level, and of course the $16.50 level under there. I think that it’s only a matter of time before the buyers return though, as we have been consolidating. I think that sooner rather than later the buyers will return. However, also recognize that it is very choppy market in general, so trading in small positions will probably be the best way to go. This could involve either trading the CFD market, perhaps trading and physical silver. I think that we will eventually break out of the overall range, but we are a long way from doing so.

A breakdown below the $16.50 level sends the market looking for the $16 level next. I think that alternately if we can break above the $17.25 level, the market will then go look to the $17.50 level. The volatility should continue, but I think given enough time we will probably rise based upon what I’ve seen in the gold markets longer-term charts. I think this is a good opportunity to pick up silver for a longer-term investment, and therefore if you are just starting a silver position, then you are probably looking to pick up. Otherwise, you could look at a range bound system that feature something along the lines of a stochastic oscillator, which gives us an idea as to when we are overbought or oversold in the tight range that we are trading in. If you are trading the futures market, that’s probably the way to go, simply going back and forth between the $16.75 and $17.25.

SILVER Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement