Advertisement

Advertisement

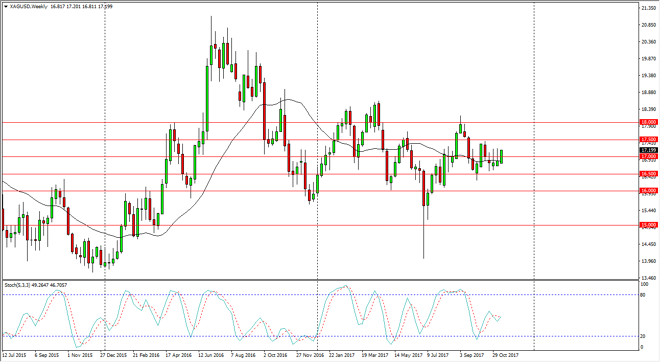

Silver Price forecast for the week of November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:32 GMT+00:00

Silver markets have been very bullish during the week, as we are testing the top of a couple of shooting stars. It looks as if we could go to the $17.50

Silver markets have been very bullish during the week, as we are testing the top of a couple of shooting stars. It looks as if we could go to the $17.50 level above, and possibly even the $18 level after that. I think that it’s a bit difficult for longer-term traders to handle though, because there are so many moving pieces and of course support and resistance levels in such a tight range. In general, I think you could say that the $16 level is the “floor” in the market, and the $18 level is the ceiling. However, it seems as if every $0.50 we see significant noise in the market, so I think longer-term traders are probably looking to buy-and-hold physical silver more than anything else. Trying to trade futures markets in this type of environment is a short-term traders game only.

If we were to somehow break above the $18 level, we would then test the $18.50 level and possibly break out for the longer-term move. I think this probably happens, but not in the short term. If we were to break down below the $16 level, it’s likely that we could go down to the $15 level. The volatility this market should continue, so I think it’s probably best to trade this market from a short-term perspective. However, for my own retirement account I’ve been buying physical silver. I believe longer-term that is a nice investment, but the entire year has been bouncing around in a $2 range, and I don’t think that’s going to change anytime soon, so if you do find yourself trying to trade this market, you need to be in the CFD or options markets. Pay attention to the US dollar, we will probably see a reverse correlation.

SILVER Video 20.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement