Advertisement

Advertisement

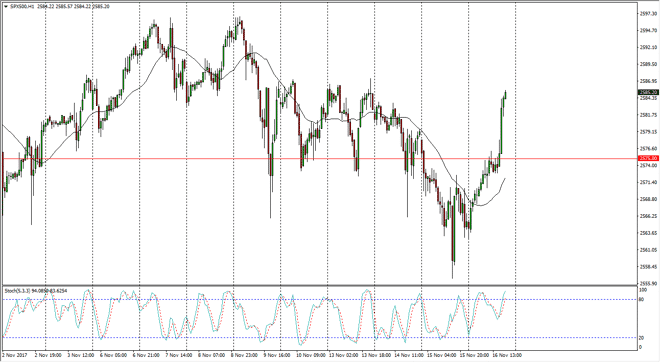

S&P 500 Index Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:00 GMT+00:00

The S&P 500 had an extraordinarily bullish session on Thursday, breaking above the 2575 handle, and racing towards the 2585 level. If the markets pull

The S&P 500 had an extraordinarily bullish session on Thursday, breaking above the 2575 handle, and racing towards the 2585 level. If the markets pull back from here, and I think they will as it is a significantly resistive barrier, I expect to find buyers in the area of the 2575 level. The market breaking above the 2587 level would then send this market towards the 2600 level, which has been massively resistive. I believe that every time we pull back, there are plenty of buyers underneath as we have seen the longer-term buyers come in and push the S&P 500 higher repeatedly. However, this type of move cannot sustain itself for very long, so it’s likely that pullbacks will be necessary to keep the momentum going forward. With Walmart and Costco showing such strong earnings, and makes sense that we continue to find reason to go long.

However, this rally has been slowing down from a longer-term perspective for a while, so I believe that we will continue to have pullbacks that offer value, but short-term traders will dominate the market until we can finally break above the 2600 level again, which quite frankly looks to be a bit difficult. If we fall below the 2560 handle again, that would be very negative, and at that point I would be willing to stand aside and wait for support at much lower levels, perhaps the 2500 level as it is a large, round, psychologically significant number and has been important in the past. I think the only thing you can count on is volatility, but it does look like the buyers are starting to pick up the momentum, so as we chop around I would favor upside trades for little scalps.

S&P 500 Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement