Advertisement

Advertisement

S&P 500 Index Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:04 GMT+00:00

The S&P 500 was very choppy and noisy during Monday trading, at least in the CFD market. You can see that Asian sold off the CFD market almost

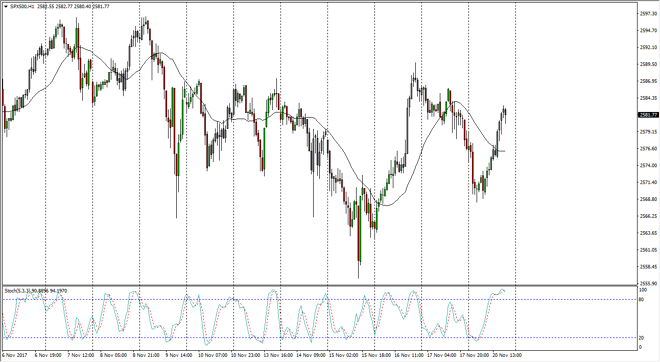

The S&P 500 was very choppy and noisy during Monday trading, at least in the CFD market. You can see that Asian sold off the CFD market almost immediately, but found support at the 2570 level to turn around and rally significantly. However, on the hourly chart we are starting to run into resistance again, and the stochastic oscillator is crossing in the overbought area. Because of this, I anticipate that some type of exhaustive candle or failure of a rally should appear that I can start selling. The 2600 level above is massively resistive, and I think it’s going to take quite a bit of work to get above there. If we can clear the 2600 level above, it’s likely that we could go much higher, perhaps to the 2650 handle next.

I think that the S&P 500 will continue to rally longer-term, but we have rallied so quickly without a major pullback that I think we are starting to see signs of fatigue. The market is very significantly supportive near the 2550 handle, and then the 2500 level after that. I don’t think we will break down below 2500, but I would like to see an attempt to at least get down there from a longer-term perspective. As far as buying is concerned, I have no interest in doing so until we break above 2600, or get the pullback that I think we need to offer value yet again. The S&P 500 isn’t a market that I’m interested in shorting, so if we do fall from here I am more than willing to sit on the sidelines and simply wait for buyers to return as they almost certainly will. Algorithmic trading has kept this market a bit afloat over the last couple of years, and that may continue to be the case.

S&P 500 Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement