Advertisement

Advertisement

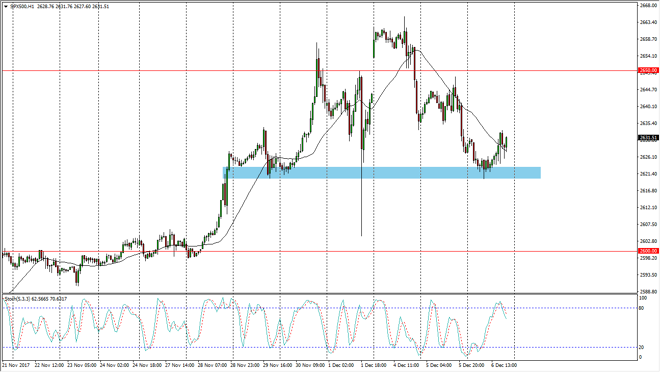

S&P 500 Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:03 GMT+00:00

The S&P 500 had a choppy session on Wednesday, testing the 2620 handle, but then bouncing to show signs of life again.

The S&P 500 initially fell during the trading session on Wednesday, but found enough support at the 2620 handle again to rally, suggesting that we are going to continue to be very choppy but algorithmic traders seem to be hell-bent on lifting the market. I think eventually we will go looking towards the 2650 handle above, which has been massive resistance. I think pullbacks are helpful in this market though, because we are bit overextended anyway, and I believe that the 2600 level underneath should continue to be massively important for the uptrend. In fact, it’s a bit of a “floor” from what I can see.

If we break down below the 2600 level, then I think the market probably goes down to the 2550 level after that. In general though, I believe that easy money and corporate profits continue to favor the S&P 500 going higher. I think that longer-term, the markets probably go looking towards the 2700 level, but these pullbacks are necessary to build up enough momentum as we had rallied far too far into short of an area. For me, I believe that this market is probably best traded in the options market if you have that ability, perhaps selling premium. However, CFD markets work as well, as you can use small positions to bet on the upside as we see plenty of interest in this market every time it dips. The algorithmic traders have been a major driver of the S&P 500, and even though we are a bit overstretched, at this point it looks as if selling pressure simply cannot last for very long.

S&P 500 Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement