Advertisement

Advertisement

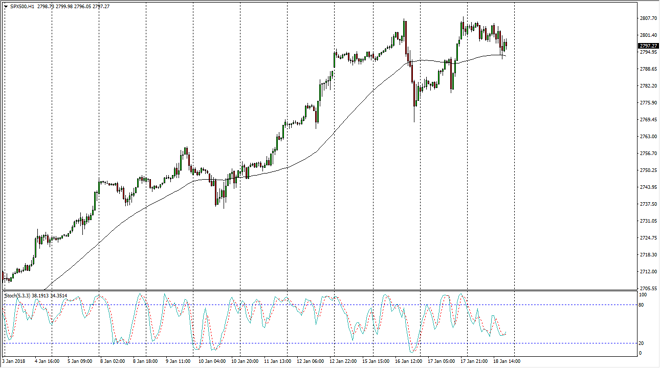

S&P 500 Price Forecast January 19, 2018, Technical Analysis

Updated: Jan 19, 2018, 05:49 GMT+00:00

The S&P 500 has drifted a bit lower during the trading session on Thursday, but continues to find support just below the 2800 level. The market should continue to be bullish overall, and I think that this drift lower is probably a buying opportunity. If we can break above the 2810 handle, the market continues to go much higher.

The S&P 500 drifted a bit lower during the trading session on Thursday, but then found a bit of support near the 2790 handle. I think that the market will ultimately go higher, and therefore I remain bullish, but I recognize that these pullbacks may be necessary build up the momentum that is needed to continue. I believe that the algorithmic traders are going to keep this market from falling, and the potential uptrend line that is just below could also give us plenty of reason to go long. Longer-term, I believe there is a target to be made of the 3000 handle, but obviously we won’t get there anytime soon, it’s going to take a lot of momentum to reach that level.

At this point, I think that the 2780 handle offers a lot of support as well, so I look at that as value. And that’s how you are going to have to trade this market, from a value perspective. I believe that the S&P 500 is one of the better vehicles to chase economic growth right now, and especially considering that the United States is going to be a much more tax friendly place for businesses. It’s obvious to me that the only thing you can do in this market is by. Stock markets around the world continue to strengthen, and the S&P 500 won’t be any different.

S&P 500 Video 19.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement