Advertisement

Advertisement

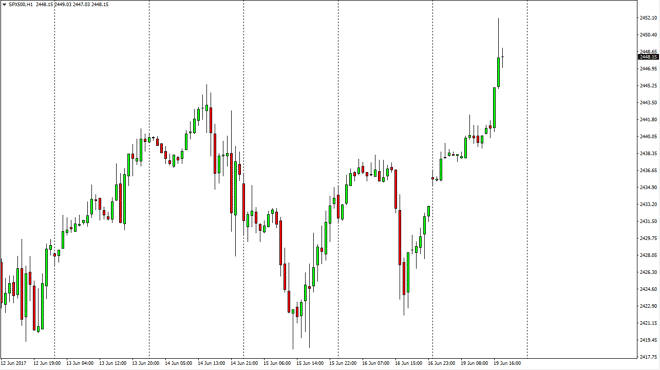

S&P 500 Price Forecast June 20, 2017, Technical Analysis

Updated: Jun 20, 2017, 05:08 GMT+00:00

The S&P 500 gapped higher at the open on Monday, and then shot towards the 2450 handle, which was my next target. I believe that we are going to

The S&P 500 gapped higher at the open on Monday, and then shot towards the 2450 handle, which was my next target. I believe that we are going to continue to reach higher, perhaps head to the 2500 handle after that. I believe that the bullish tendency of this market is starting to show itself again, so therefore I have no interest in trying to fight this trend. I believe that the 2500 level will be broken to the upside given enough time, but in the meantime, it should be several pullbacks just waiting to happen, and more importantly, offer buying opportunities. I think that the gap below near the 2430 handle is going to act as a bit of a “floor”, and more importantly, the floor has moved higher. That shows that the buyers are starting to become even more aggressive, and that of course is a good sign for those of us that are buying.

Buying value

I believe that the market continues to buy value, and with that being the case it’s likely that the longer-term traders are looking at this as a good sign going forward, and I think they are starting to pick up dips as well. The market breaking above the 2500 level then sends the market too much higher levels, the longer-term leg hire is exactly what would be happening, and of course this should send this market higher for longer-term buy-and-hold type traders as well. We continue to see volatility, but in volatility I continue to see opportunity. It does not until we breakdown below the 2400 level that I feel the market has changed directions, which of course is something that I don’t see happening anytime soon, especially as earnings were reasonably strong this past season.

S&P 500 Video 20.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement