Advertisement

Advertisement

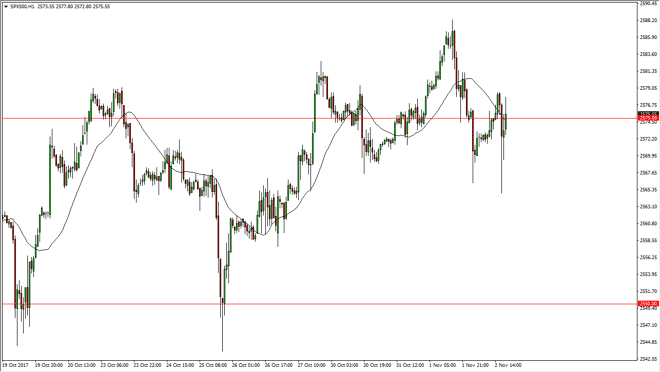

S&P 500 Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:19 GMT+00:00

The S&P 500 had a choppy session during the trading session on Thursday, as we continue to hover around the 2575 level. This is a market that

The S&P 500 had a choppy session during the trading session on Thursday, as we continue to hover around the 2575 level. This is a market that continues to be very noisy, but is not surprising that we couldn’t do much during the day on Thursday as we await the jobs number today. We are expecting to see a print of 310,000 jobs at it for the month of October, and the market should move accordingly. If the number beats, it could go higher, but at the same time if it fails to reach that level, we could fall towards the 2550 handle. I think longer-term though, even if the number disappoints, people will look at that as likelihood of the Federal Reserve sitting on the sidelines a bit longer, thereby keeping the easy monetary policy intact. That is good for stock markets, and by extension the S&P 500.

Beyond that, the earnings season has been rather strong, and it should continue to push the stock market higher. The pullback from here should only offer value, and hopefully the rest of the market will see that as such. I have significant support marked on the chart at the 2550 level, and I would be surprised if we break down below there. Quite frankly, we would need some type of catastrophic jobs number to make that happen. If it’s anywhere near what we are expecting, I anticipate that we will continue to see the general upward momentum continue. If we can break above the 2600 level, the market can continue its longer-term uptrend. I have no interest in shorting this market, although I do recognize that we are overextended from the longer-term perspective, but that should only be an opportunity to pick up value.

S&P 500 Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement