Advertisement

Advertisement

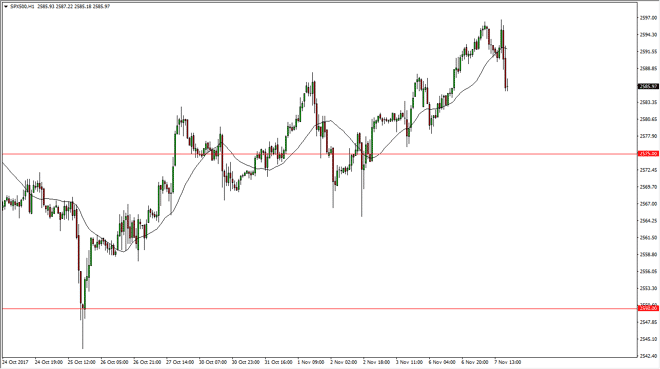

S&P 500 Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 08:24 GMT+00:00

The S&P 500 initially tried to rally during the day on Tuesday but found the 2600 level to be far too exhaustive to continue going higher. I believe

The S&P 500 initially tried to rally during the day on Tuesday but found the 2600 level to be far too exhaustive to continue going higher. I believe that the market should continue to find a bit of resistance above because quite frankly we have been overbought for quite some time. I think that a pullback is healthy and that breaking above the 2600 level should be difficult because quite frankly we have not had a significant pullback in the S&P 500 for what seems like ages. I believe that the 2575 level underneath should be massively supportive, but if we break down below there, I become even more interested in buying this market at lower levels, as it represents quite a bit of support. The 2550 level underneath should be massively supportive as well, and I believe that it’s likely to offer enough value to attract interest. Either way, I don’t have any interest in shorting this market, because quite frankly it is in a bullish trend, and that has not changed.

S&P 500 Video 08.11.17

Earnings season has been very bullish overall, and I believe that although things are good, pullbacks are necessary for these types of moves. I believe that the 2600 level will be broken above eventually and that we will continue to go even higher. However, look for value as paying up is one of the easiest ways to lose money in the market. Be patient, there should be plenty of opportunities going forward. This will be especially true for the next several months, which are typically good for stock markets in general. I think that the 2500 level underneath should be the absolute “bottom” of the uptrend, and if we can stay above there, it’s likely that selling is all but an impossibility.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement