Advertisement

Advertisement

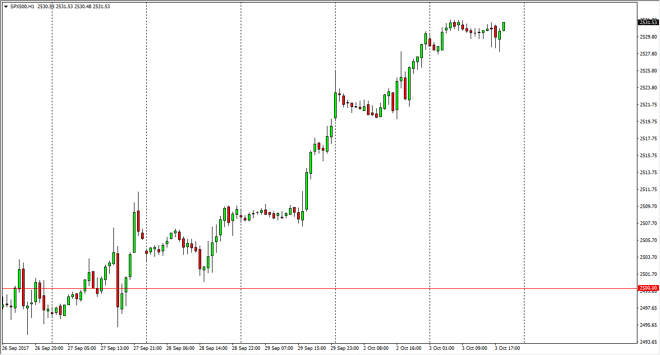

S&P 500 Price Forecast October 4, 2017, Technical Analysis

Updated: Oct 4, 2017, 07:02 GMT+00:00

The S&P 500 rose slightly during the day on Tuesday, as we continue to see the market operate in a “buy on the dips” mindset. I think that the S&P

The S&P 500 rose slightly during the day on Tuesday, as we continue to see the market operate in a “buy on the dips” mindset. I think that the S&P 500 will continue to reach towards the 2550 level above, and I think the dips offer value the people will take advantage of. I also believe that there is a “floor” in the market closer to the 2500 level, and of course, the 2525 level underneath is the initial support. I like buying these dips, as it is a market that is strong, and of course, has to lead the way as stock markets, in general, have done quite well. There has been a sector rotation out of technology and into industrial’s and financials, so it makes sense that the S&P 500 continues to strengthen.

S&P 500 Video 04.10.17

With financial strengthening, it makes sense that the S&P 500 will do quite well as various companies like JP Morgan, Wells Fargo, Citigroup, and much more are starting to find a bit of a bit. I think that the 2550 level will be resistive, but given enough time we should build up enough momentum to continue through that level. Again, we will see volatility occasionally, but that typically doesn’t happen to matter much, and I think that the markets will find plenty of reasons to go higher, as quite frankly the algorithmic trading alone has prevented this market from dropping more than 1% for months, and I don’t think that’s going to change anytime soon. Longer-term, the markets continue to favor the buyers, and I believe that the overall uptrend is extraordinarily strong and therefore this is a market that cannot be sold. Quite frankly, there’s no reason to think that were going to roll over, and if the US dollar falls over, that will only propel the markets even fire.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement