Advertisement

Advertisement

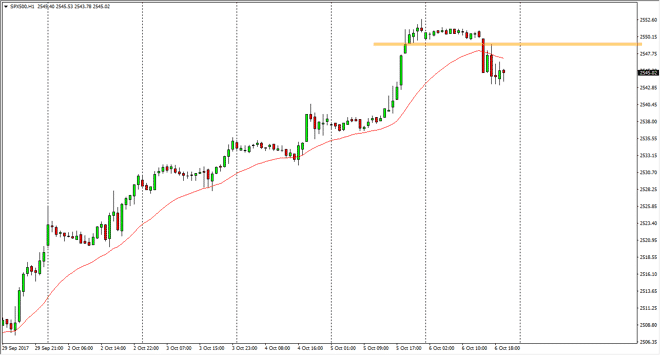

S&P 500 Price Forecast October 9, 2017, Technical Analysis

Updated: Oct 8, 2017, 08:16 GMT+00:00

The S&P 500 went sideways initially on Thursday, but after the jobs number came out, we fell down towards the 2545 handle. I think that we will

The S&P 500 went sideways initially on Thursday, but after the jobs number came out, we fell down towards the 2545 handle. I think that we will eventually break out to the upside, continuing the move higher. If we can break above the 2550 level, that’s the signal that the buyers are starting to take advantage of the uptrend. Even if we pull back from here, I think there is plenty of buying pressure underneath, so this is a “buy only” market as far as I can see. The fact that we fell a bit during the day on Friday isn’t much to consider, considering that we have been in a massive move higher, and the pullback was probably needed for the market to build up enough momentum to continue to go much higher.

S&P 500 Video 09.10.17

Buying the dips going forward is my plan, as it has worked so well for some time. I believe that the market has the “floor” at the 2500 level that will keep this market lifted, and I believe that eventually, we will go looking towards the 2600 level. There has been a move out of technology and into financials lately, which has been leading the S&P 500 higher. Ultimately, I think that continues to be a theme here, especially with banks such as J.P. Morgan being so strong. Bank of America has recently broken out as well, so I think that S&P 500 traders will continue to be very bullish. Part of the pullback on Friday was probably in reaction to the North Korean claim that they were going to test a rocket over the weekend that can reach the West Coast of the United States, as traders will be looking to hold positions over the weekend.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement