Advertisement

Advertisement

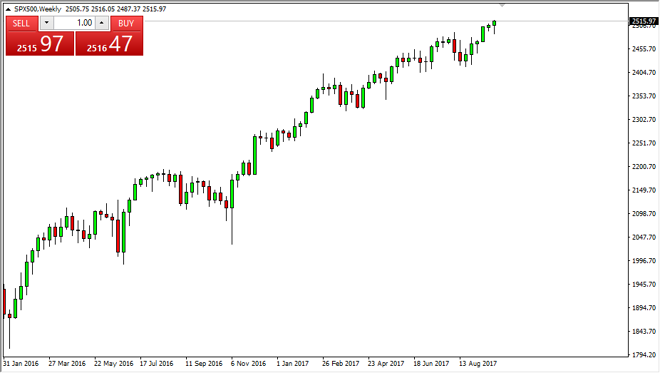

S&P 500 Price Forecast for the Week of October 2, 2017, Technical Analysis

Updated: Oct 1, 2017, 07:21 GMT+00:00

The S&P 500 had a relatively quiet week, initially falling but then finding enough support to turn around and form a bit of a hammer. The one thing

The S&P 500 had a relatively quiet week, initially falling but then finding enough support to turn around and form a bit of a hammer. The one thing that I do notice is that it seems that the 2500 level is going to offer support, that’s a very bullish sign for buyers. I believe that this remains a “buy on the dips” situation, as traders find reasons to go along. I think that algorithmic trading has a lot to do with that as well, and you can’t find machines when acting like this. I believe that the 2490 level underneath is massive support, which is now substantively the bottom of a hammer. Because of this, I think that as we dropped lower on short-term moves, buyers will continue to flood the market as we have seen such tenacious support. Ultimately, the market should find themselves favorable, and it looks as if we are setting up for a good fourth quarter.

S&P 500 Video 02.10.17

The Federal Reserve has already made its intentions known, so a tightening of the balance sheet shouldn’t hurt the markets too much because they certainly haven’t been overly concerned about it. With this, I believe that we are going to go to the 2525 level, and then eventually the 2550 level. I like buying dips, have no interest in shorting, at least not until we break down below the 2400 level, something that doesn’t look very likely to happen anytime soon. Ultimately, I think that this is an uptrend that still has plenty of room to move, and I believe that even though we have been a bit stretched at times, this has been a very healthy uptrend. Selling is not an option until we break down below the aforementioned 2400 handle.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement