Advertisement

Advertisement

Technical Checks For GBP/USD, EUR/GBP, GBP/JPY & GBP/CHF: 28.09.2017

By:

GBP/USD Ever since the GBPUSD reversed from 1.3660, the pair has been gradually declining and it recently tested the 1.3340-30 horizontal-area. However,

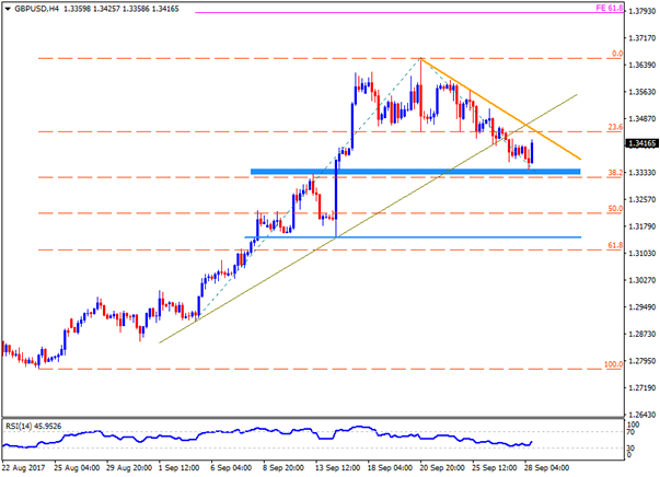

GBP/USD

Ever since the GBPUSD reversed from 1.3660, the pair has been gradually declining and it recently tested the 1.3340-30 horizontal-area. However, oversold RSI and presence of strong support-zone indicate brighter chances of the pair’s pullback towards 1.3410 and then to the short-term descending TL figure of 1.3460. Should the quote manage to extend its recovery beyond 1.3460, the 1.3540, the 1.3560 and the 1.3600 are likely following numbers to appear on the chart, which if broken could help escalate the north-run to the 1.3710 and to the 61.8% FE level of 1.3790. If at all the Bears drag prices below 1.3330, the 1.3250 and the 1.3220 could quickly pop-up as supports before igniting the importance of 1.3145 horizontal-line. Moreover, sellers’ dominance over sentiment after 1.3145 can direct the pair moves to the 1.3050 and the 1.3000 psychological mark.

EUR/GBP

EURGBP’s bounce from 0.8745-40 horizontal-line is presently helping it to aim for 0.8830 and the 0.8860 resistance-levels ahead of looking at the 100-day SMA level of 0.8890. Given the pair’s ability to surpass 0.8890, also clear 0.8900 mark, the 0.8920 could act as intermediate halt before pushing buyers to target 0.8990-95 horizontal-line. Alternatively, a daily close below 0.8740 might avail 200-day SMA level of 0.8720 as rest-point, which if broken could fetch the quote to 0.8690 and the 0.8645 supports. During the pair’s sustained trading beneath 0.8645, the 0.8600 and the 0.8530 can entertain traders.

GBP/JPY

With an immediate descending trend-line restricting GBPJPY’s up-moves at 151.30, the pair is likely to revisit the 149.70-60 horizontal-region. Though, break of 149.60 seems a trigger for the pair’s fresh selling towards 148.30 and then to the 147.40-35. In case if the prices continue declining after 147.35, the 146.65-60 should limit additional downside. Meanwhile, a clear break of 151.30 TL could stretch the pair’s latest recovery to 151.60 and to the 152.30 ahead of increasing the significance of last-week’s high, i.e. 152.85, which if broken could open the door for the pair’s northward trajectory towards 153.65 level, comprising 61.8% FE level.

GBP/CHF

Having repeatedly failed to dip below 1.3000 round-figure, the GBPCHF seem finally heading to 1.3080 and then to the 1.3100 resistance-levels. However, 1.3110 and the 1.3170 could confine its following upside. Should Bulls refrain to respect the 1.3170, the recent high around 1.3195 and the 61.8% FE level of 1.3250 should appear in their radar. On the contrary, pair’s decline below 1.3000 can drag it to 1.2970 and to the 1.2945 support-line, breaking which 1.2865 may grab attention of sellers. In case if the pair weakens beneath 1.2865, it seems wise to expect 1.2800 as support.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement