Advertisement

Advertisement

Technical Checks Of Gold, Silver & WTI Crude Oil – 06.01.2017

By:

GOLD Ever since the Gold reversed from $1126-28 support-zone, it managed to extend advances to the present level near a month’s high. However, $1197 -

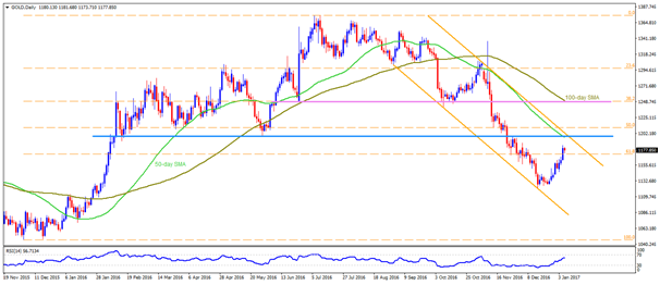

GOLD

Ever since the Gold reversed from $1126-28 support-zone, it managed to extend advances to the present level near a month’s high. However, $1197 – $1200 horizontal resistance-region, comprising 50-day SMA, may give a tough fight to the Bullion, which if broken needs to confirm price-strength by surpassing four-month old descending trend-channel resistance, at $1205 now. Given the metal successfully trades beyond $1205, the $1233-34 may act as an intermediate halt before it could challenge another important area of $1248-50, which includes 38.2% Fibonacci Retracement level of December 2015 – July 2016 upside and 100-day SMA. In case if strong US Jobs report drag the yellow metal towards south, $1166-65 is likely an immediate support to watch before we examine chances to witness $1148-45 and then to $1128-26 re-test. If the quote fails to respect $1126, it becomes vulnerable enough to plunge towards $1100 and the channel support-line of $1088.

SILVER

Alike Gold, the Silver is also heading towards its short-term immediate resistance level of $16.90, comprising 50-day SMA, but is likely to face few obstacles from US details due to recent improvement in Chinese data-points and may clear the mentioned SMA figure, which in-turn favor its upside to $17.20. Should the white-metal break $17.20, the $17.60 could entertain intermediate traders before fueling prices to $17.75-80 region, encompassing 200-day SMA and resistance-line of nearly four-month old descending trend-channel. Given the Bull-power persists beyond $17.80, it becomes wise to expect $18.45-50 on the chart but a broader downward slanting TL, at $18.70, could restrict its further upsides. Alternatively, $16.30-25 seems a nearby support for the metal, breaking which $15.90 and the $15.65 are likely following downside figures to watch. However, its further declines below $15.65 could be confined by channel-support of $15.25, which if broken might drag prices to $14.75.

WTI CRUDE OIL

Even as month-old ascending trend-line support triggered Crude upswing, the important $54.65-70 area, comprising ascending trend-line and recent high, could restrict its further advances. If at all the energy vehicle rallies beyond $54.70, the 61.8% FE level of $56.00 is likely next-stop before confronting another important resistance-region of $56.50-60, which if broken could fuel northward trajectory towards $59.00 and then to $60.00. Meanwhile, $52.90 and the $52.20 are expected nearby supports for prices, clearing which previously mentioned trend-line figure of $51.80 again comes into play. Should Bears gain command over Oil below $51.80 support, chances of the quote’s plunge towards $49.80 can’t be denied.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement