Advertisement

Advertisement

Technical Checks For Gold, Silver & WTI Crude Oil: 21.07.2017

By:

GOLD Gold’s reversal from $1205-04 support-zone is presently being questioned by 50-day & 100-day SMA confluence region of $1248-49, which if can’t

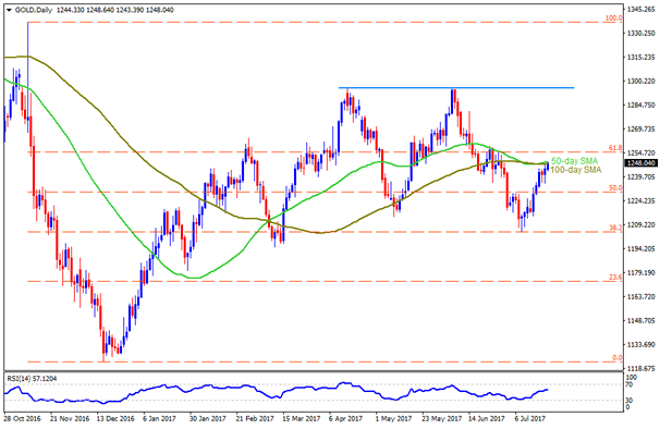

GOLD

Gold’s reversal from $1205-04 support-zone is presently being questioned by 50-day & 100-day SMA confluence region of $1248-49, which if can’t compress the yellow metal’s recovery might flash $1260 on the chart. During the Bullion’s additional up-moves beyond $1260, the $1271 and the $1283 are likely important levels, breaking which $1295-96 “Double-Top” comes into play. On the contrary, the $1235, the $1228 and the $1216 seem nearby supports that the precious-metal traders should watch before targeting the $1205-04 while being short. Should prices drop below $1204 on a daily closing basis, $1200 and the $1193 might re-appear as quotes.

SILVER

Even after trading near the highest levels in more than two-weeks, Silver might find it difficult to surpass $16.50-55 confluence-region, comprising an upward slanting resistance-line and a horizontal-line. However, the white-metal’s break of $16.55 enables it to challenge another resistance-zone around $16.85-90, breaking which $17.15, the $17.30 and the $17.50 can please Bulls. Meanwhile, $16.30 and the $16.15 TL could offer immediate rests to the metal during its pullback but a break of $16.15 would confirm a short-term “Rising-Wedge” bearish formation and may trigger the Bullion’s south-run towards $15.85 & $15.75 supports. In case if sellers refrain to respect $15.75, chances of witnessing $15.45 and the $15.00 on the chart can’t be denied.

WTI CRUDE OIL

Following its failure to surpass a month-old ascending trend-line, the Crude prices are likely declining in direction to $45.80-75 support re-test, clearing which $45.30 and an upward slanting TL, at $44.80, could try limiting the energy quotes. If at all the crude closes below $44.80 on a daily closing basis, it confirms the “Rising-Wedge” formation and signals a drop to $43.50 and the $43.00 before challenging the $41.80 support. Alternatively, $47.20 and the $47.60 TL, followed by 100-day SMA level of $47.90, can keep limiting the Crude’s near-term advances, breaking which $48.30 is likely buffer which can increase the importance of three-month old descending TL resistance, at $49.00. Should prices continue rising after $49.00, the $49.80 and the $50.30 can be expected to appear.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement