Advertisement

Advertisement

Technical Checks: USD/CHF, EUR/CHF, CHF/JPY And CAD/CHF

By:

USD/CHF While 0.9905-10 horizontal resistance continue restricting the USDCHF upside, the pair presently tests the support-line of short-term ascending

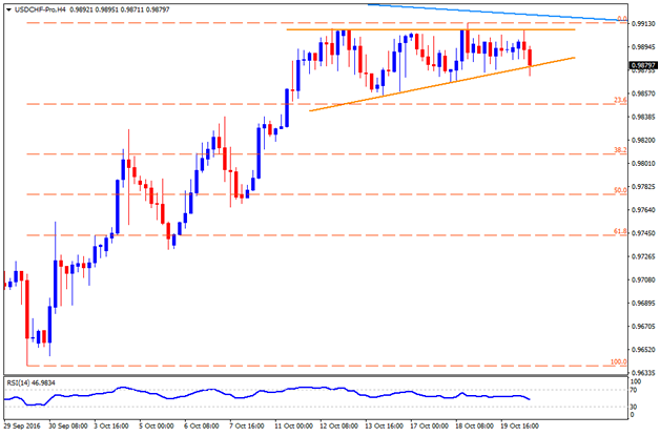

USD/CHF

While 0.9905-10 horizontal resistance continue restricting the USDCHF upside, the pair presently tests the support-line of short-term ascending triangle, around 0.9875, breaking which can trigger its quick decline to 0.9855 and the 0.9835 support levels. Should the pair continue running down below 0.9835, the 0.9790 and the 0.9765 are likely number to its south that could appear on the chart. Alternatively, 0.9890 can provide immediate upside stop to the pair before it could confront the 0.9905-10 pattern resistance. However, pair’s further advances beyond 0.9910 needs to break a broader TL resistance, connecting November 2015 and January 2016 highs, at 0.9925, ahead of targeting the 1.0000 psychological magnet.

EUR/CHF

Alike USDCHF, the EURCHF also follows a triangle formation but a symmetrical one, indicating sideways move to continue. The pair currently trades around pattern support-line of 1.0845, a closing break of which can fetch the quote to 38.2% Fibonacci Retracement of its May – June plunge, at 1.0815. Given the prices maintain downtrend below 1.0815, the 1.0790 and the 1.0765 might entertain intermediate sellers prior to opening the door for the pair’s southwards trajectory towards 1.0700 mark. In case the pair fails to close below 1.0845, the 1.0865 and the 100-day SMA level of 1.0895 are likely nearby resistance to limit its advances, breaking which 1.0920 can come into play. If the quote surpasses 1.0920, it needs to confront with 200-day SMA level of 1.0940 before challenging the pattern resistance-line of 1.0960.

CHF/JPY

Even if the CHFJPY recently bounced-off from 104.30-25 support-zone, a short-term descending trend-line resistance of 105.25 is likely to restrict its further upside. Given the pair manage to clear the 105.25, the 105.50 and the 105.75 are likely north-side figures to appear on the chart, breaking which it becomes capable to march towards 106.00 and then to current-month high of 106.45. Meanwhile, 50% Fibonacci Retracement of its latest upside, at 104.60, followed by 104.30-25, can continue limiting the pair’s downside attempts, which if cleared can give rise to expectations of 103.80 and the 103.40 support-test by the pair-quote.

CAD/CHF

Five-month old descending trend-channel again restricted the CADCHF’s advances, indicating quick re-test of 0.7485 mark, comprising 100-day SMA, clearing which can further strengthen the Bears to drag the quote towards 0.7440 and the 38.2% Fibonacci Retracement of its January – April upside, at 0.7380. Though, pair’s additional weakness below 0.7380 can only have 0.7350 before it could find the reversal-point of channel support, around 0.7280, which if failed can flash 0.7230 on the chart. On the upside, channel resistance-mark of 0.7560 becomes an important level for the pair traders to watch, a closing break of which can trigger its north-run to 0.7600 and the 0.7630 consecutive resistances. Should the pair surpasses 0.7630, the 0.7670 can offer an intermediate halt before it could confront the 0.7725-35 horizontal resistance area which aptly restricted the pair’s north-runs in November 2015 and April 2016.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement