Advertisement

Advertisement

Technical Outlook – AUDJPY, NZDJPY and AUDNZD

By:

AUDJPY Having dropped from the 89.50-30 horizontal support, AUDJPY plunged below 61.8% FE and 100% FE of its November 2014 – February 2015 decline;

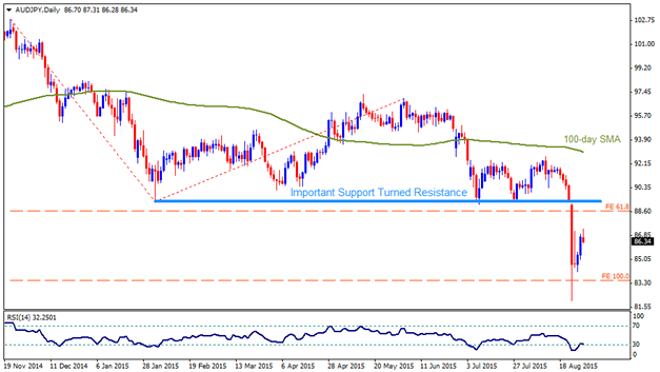

AUDJPY

Having dropped from the 89.50-30 horizontal support, AUDJPY plunged below 61.8% FE and 100% FE of its November 2014 – February 2015 decline; however, a bounce from the lows, near 82.00 round figure mark pulled the pair back to its 86.50 area, signaling 88.60-70 region, should it manage to hold the recent up-move intact. Further advance beyond 88.60 area likely to be capped by mentioned support now turned resistance region, 89.30-50 while a sustained break of which negates pair’s chances of near-term declines, fueling it towards 92.00 round figure mark prior to testing 100-day, presently near 93.00 level. Alternatively, 85.50 is likely level that could again trigger pair’s decline towards first 84.00 round figure mark and then to the recent lows near 82.00 level. Moreover, continued declines below 82.00 can make the pair vulnerable to plunge below its 80.00 psychological magnet.

NZDJPY

Break of 80.60-50 support area triggered NZDJPY declines towards recent lows of 72.37; however, short-covering rally resumed the pair near 78.30 level. Given the pair extends its recent pullback, the 80.50-60 becomes an important level to determine the pair’s near-term moves, breaking which 83.00 – 83.20 horizontal area, including 50% Fibo connecting December 2014 highs to recent lows, is a strong resistance region to limit further upside by the pair. On the downside, 23.6% Fibo, near 77.50 is likely immediate support for the pair, breaking which 76.00 round figure mark is an important support that can restrict the pair’s short-term downside. Should the pair extends the decline below 76.00, chances are higher that it can again target its recent lows of 72.37 with 75.00 being intermediate rest.

AUDNZD

Irrespective of its spike on Monday, the AUDNZD, maintained its slow decline pace wherein 23.6% Fibo of its May – July up-move, coupled with 50-day SMA, near 1.1150-70 area, restricts the pair’s immediate up-move while the near-term declines are limited by the 1.0890 – 1.0875 horizontal area, encompassing 100-day SMA and the 50% Fibo of the said move. With comparative strength of NZD, the pair is more likely to test mentioned 1.0890 – 1.0875 support area than to rallying other-way. Should it successfully break 1.0875 on a closing basis, it can quickly plunge to 61.8% Fibo, near 1.0750 and then to the 1.0650 level, breaking which it is likely to test 1.0500 round figure mark. On the upside, a closing break above 1.1170 is likely be capped by the short-term descending trend-line, near 1.1250 and the 1.1300 round figure mark. Given the pair’s ability to surpass 1.1300, it becomes capable of targeting 1.1380 and the July high of 1.1430 prior to testing 1.1550, 61.8% FE of the said move.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement