Advertisement

Advertisement

Technical Outlook – EURGBP, EURJPY, EURAUD and EURNZD

By:

EURGBP Having bounced from 0.6950-30 support region during last week, the EURGBP managed to rally towards a month’s high; however, 100-day SMA and the

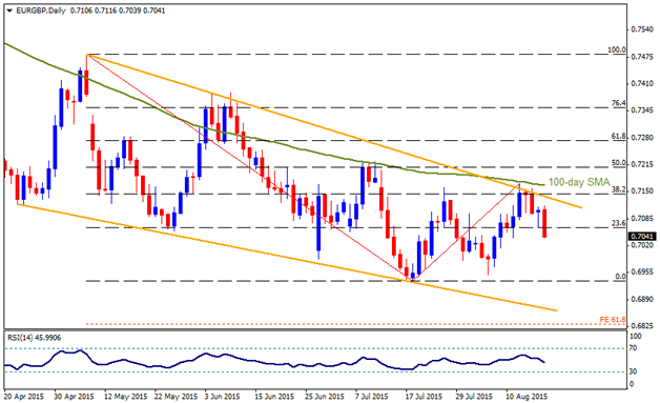

EURGBP

Having bounced from 0.6950-30 support region during last week, the EURGBP managed to rally towards a month’s high; however, 100-day SMA and the resistance line of “falling-wedge” formation restricted further advance by the pair that presently trades near 0.7040-35 support-zone. From the current level, 0.6990 and the 0.6950-30 are likely immediate support to restrict the pair’s decline, breaking which 0.6870-65 could limit the pair’s additional downside towards 0.6830, 61.8% FE of its May – August decline. Meanwhile, 0.7115-20, quickly followed by the formation resistance, 38.2% Fibo and the 100-day SMA, near 0.7145-65 area, become strong barrier to cap the pair’s near-term upside. Moreover, a daily close above 0.7165 confirms the bullish formation, fueling the pair towards 0.7390 – 0.7400 area with 0.7270-80 being intermediate resistance.

EURJPY

Failure to break the 138.85 – 139.00 horizontal mark seems dragging down the EURJPY towards re-test of 136.90-60 broad support-region, including 50-day SMA and the four month old ascending trend-line support. If the pair plunges below 136.60 on a closing basis, it can quickly plunge to 133.50-30 support area, including 50% Fibo of the April – June up-move, breaking which the 131.50-40 could become consecutive rest point for the pair. Alternatively, a sustained break of 139.00 is likely to be followed by the 140.00 – 140.10 resistance region, breaking which the pair can stand near 141.00 round figure mark prior to extending its upward trajectory towards 61.8% FE of the pair move, near 142.50-55 area. On an extended advance beyond 142.55, the pair can rally towards 144.60-70 resistance region that restricts the pair’s medium-term up-move.

EURAUD

Even if the 1.5305-25 horizontal restricted the pair’s surge during last week, the four month old ascending trend-channel keep favoring the pair’s near-term up-move. Currently, 1.4900, followed by the 1.4770-50 support-zone, including 50-day SMA, channel support and the 50% Fibo of its January 2014 to April 2015 decline, could provide strong support to limit the pair’s immediate declines. Should the pair closes below 1.4750, it becomes vulnerable to plunge towards 1.4550 and the 1.4400 support levels. On the upside, a break of 1.5325 favors the pair’s upward trajectory towards 1.5485 – 1.5500 resistance-zone while an extension beyond 1.5500, also breaking the 1.5530-35, may provide the pair a strong support to target 1.5800 area.

EURNZD

Two month old ascending trend-channel favors the EURNZD up-move that is currently witnessing a pullback towards 1.6700 mark, breaking which mentioned channel support, near 1.6600 round figure, provides a strong support to restrict further declines by the pair. Given the pair’s inability to stand near 1.6600, it can plunge to 23.6% Fibo of its April – August up-move, near 1.6330, prior to targeting 1.6150 and the 1.5850 levels. Should the pair reverses from the 1.6700 area, the 1.6935 is likely intermediate resistance before the pair could test the recent highs near 1.7100 round figure mark, that also includes the channel resistance. Further advances by the pair, above 1.7100 are likely to be capped by the 1.7270 horizontal mark, including the August 2013 highs.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement