Advertisement

Advertisement

Technical Outlook – Important GBP Pairs

By:

GBPUSD Although, the GBPUSD managed to close above 1.5730 horizontal mark on Monday, upbeat consumer confidence and durable goods orders provided

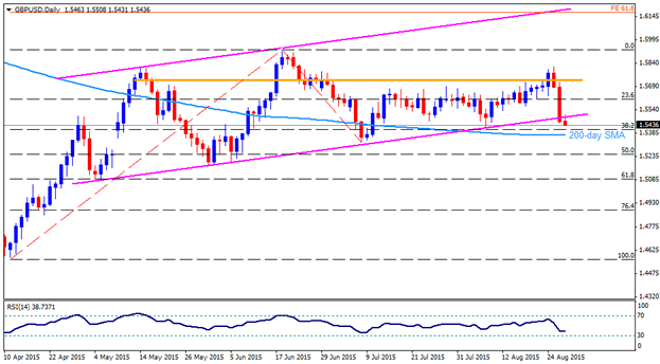

GBPUSD

Although, the GBPUSD managed to close above 1.5730 horizontal mark on Monday, upbeat consumer confidence and durable goods orders provided considerable strength to the greenback during Tuesday and Wednesday, pulling back the pair towards breaking the short-term ascending trend-channel support. However, 200-day SMA, presently near 1.5370, can restrict the pair’s immediate declines, breaking which 50% Fibo of April-June up-move, near 1.5250, and the 1.5180-70 are likely consecutive supports that the pair can witness during its extended downward trajectory. Should the pair manages to close below 1.5170, it can quickly plunge to 1.4900 area while 1.5100 – 1.5080 and the 1.4980-75 can act as an intermediate rest for the pair. Alternatively, a close above 1.5530 negates the recent break, fueling the pair towards 23.6% Fibo, near 1.5600 round figure mark prior to targeting 1.5730 and the 1.5800 resistances. Moreover, a sustained up-move beyond 1.5800 area could pave the way for pair’s surge towards June highs, the 1.5930, breaking which channel resistance and the 61.8% FE of the said move, near 1.6170-75 area, is likely restricting extended rise by the pair.

EURGBP

Monday’s swift rally above 0.7380 – 0.7400 horizontal region lost its vigor during the following trading days as the EURGBP failed to close above 200-day SMA and the 38.2% Fibonacci Retracement of its November 2014 – July 2015 decline. Present weakness on the part of the pair seems favoring a decline towards 0.7240-20 support-zone, breaking which 0.7150-40 support area can become an intermediate support before the pair could target the 0.7050-40 region. Moreover, a close below 0.7040 can quickly fetch the pair to 0.6980-75 and to the July lows of 0.6940 while a break of 0.6940 is likely making the pair vulnerable to break the 0.6800 round figure mark, testing 61.8% FE of the said move, near 0.6750-40 area. On the upside, 200-day SMA and the 38.2% Fibo, near 0.7350-60, could continue providing strong resistance to restrict the pair’s immediate up-move, breaking which 0.7380 – 0.7400 region and the 50% Fibo, near 0.7480, are likely consecutive resistances on the pair’s consecutive surge. Given the pair’s ability to counter 0.7480, it becomes more likely to target 0.7600 mark before rallying to 0.7740-50 resistance-zone.

GBPJPY

Ever since the GBPJPY failed to surpass 195.00 mark, it kept running the decline towards 200-day SMA and with 50% Fibo of its April – June up-move, near 185.50-40 area. However, oversold RSI and inability to close below the said region keep favoring the pair’s pullback towards 38.2% Fibo, near 187.80, breaking which 189.50-60 region can act as an intermediate resistance for the pair before it could rally to 23.6% Fibo, near 191.00 round figure mark. Moreover, a sustained trading above 191.00 can fuel the pair towards 192.00 and the 192.80 – 193.00 resistance-zone. On the downside, pair’s inability to hold the support with a close below 185.40 could quickly fetch it towards 184.00 prior to testing 183.00 – 182.90 support area, including 61.8% Fibo. If the pair continues extending the decline below 182.90, it can plunge to 181.30 and the sub-180 mark, testing 179.80, encompassing 76.4% Fibo.

GBPAUD

Even if the GBPAUD failed to sustain the four-month old ascending trend-channel resistance, the pair is less likely to break the 2.1220 – 2.1200 support area, including the channel support while 2.1450-40, encompassing 23.6% Fibonacci Retracement of its January – August advance, could act as an intermediate support. Should the pair fails to stop the decline near 2.1200, it could plunge to 2.0860-50, 38.2% fibo prior to targeting the 2.0350-40 area that includes the 50% Fibo and the 100-day SMA. On the reverse side, a close above 2.1800 could flip the pair to 2.2000 round figure mark, breaking which the channel resistance, near 2.2130-40 becomes a strong level that could control the pair’s advance. Should the pair manages to break 2.2140, recent highs near 2.2400 round figure mark is likely consecutive resistance during the pair’s successive advance.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement