Advertisement

Advertisement

Technical Outlook: Important JPY Pairs

Updated: Aug 25, 2015, 07:00 GMT+00:00

Ever since the IMF downgraded its forecast for global growth, during last week, safe haven demand for the Japanese Yen helped the currency to register

Ever since the IMF downgraded its forecast for global growth, during last week, safe haven demand for the Japanese Yen helped the currency to register considerable strength against majority of its counterparts. However, with the Japanese markets closed on Monday and having no important data during the rest of the week, the currency is more likely to follow its technical traits.

Also Read: Can The US Dollar Witness Renewed Strength?

Meanwhile, the following is a brief technical overview of EURJPY, GBPJPY, AUDJPY and CADJPY pairs.

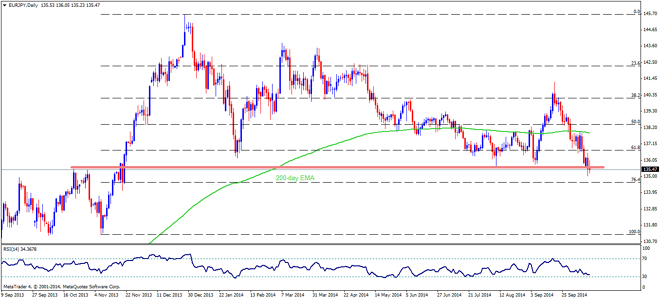

EURJPY

EURJPY is currently trading near the important horizontal support zone comprising 135.60 – 135.50 region. However, considering the downward slanting RSI and the strength of JPY, it is more likely that the pair can plunge to 76.4% Fibonacci Retracement of its November 2013 to December 2013 up-move, near 134.60 level. Should the pair declines further and closes below 134.60, it becomes vulnerable to test 133.50 levels before testing 132.50 support. Alternatively, a reversal from the important support region can pullback the pair towards 136.30 and 61.8% Fibo. level near 136.80 before rallying to 137.90 -138 resistance zone, encompassing 200-day EMA. On the sustained break of 138, the pair can rally to surpass 139.20 levels.

GBPJPY

Even after a break of 200-day EMA, the GBPJPY couldn’t decline further as the ascending trend line support, near 170.30, restricts the pair’s downturn. Moreover, RSI reversal from the oversold region is also supporting the chances of the pair’s pullback. Should it closes above 170.30 level, it is more likely to test 50% Fibonacci Retracement, connecting its February- September rally, near 171.30 level before rallying to 172.10 and 172.60 levels. A sustained trading of the pair above 172.60 can give rise to expectations of 173.80 level re-test. On the downside, a close below 170.30 can cause the pair to test 61.8% Fibo. level, near 169.50, before plunging to 168.80 and 167.40 which includes 76.4% Fibo. level. Should the pair continue trading below 167.40, it is likely to extend its downturn towards 166 level.

AUDJPY

Last week, AUDJPY breached important support zone, 94.60 – 94.70, including 200-day SMA and 38.2% Fibonacci Retracement Level of its February- September 2014 up-move, which increased chances for the pair to test 92.80 level. On the extended downtrend below 92.80, the pair can plunge to 61.8% Fibo. level near 92.20 before testing 91.30 level. On the upside, a close above 50% Fibo. level, near 92.50, can give rise to expectations that the pair can re-test 94.60 – 94.70 resistance zone. Moreover, a sustained trading above 94.70 can cause the pair to test 95.30 levels prior to testing 100-day SMA near 95.80.

CADJPY

Having breached 95.30 – 95.25 support zone yesterday, coinciding 100-day SMA and 50% Fibonacci Retracement of its March – September 2014 upturn, the pair plunged below 94.15 support level today which includes 200-day SMA and 61.8% Fibo. level, by giving rise to expectations of a 93.70 ascending trend-lie support re-test. Should the pair closes below 93.70, it is expected to test 76.4% Fibo. level near 92.80; however, 93.20 can become intermediate support. On the break of 92.80, the pair can find multiple supports near 92.00 – 92.10 support zone. On the upside, the 95.25 – 95.30 region becomes critical for the pair, breaking which 95.50, 96.10 and 96.30 (comprising 38.2% Fibo. level) can become subsequent resistances for the pair. A break of 96.30 negates the chances of short-term downtrend by the pair and makes it vulnerable to rally towards 97.60 levels.

Anil Panchal

Market Analyst

Admiral Markets

At any use of the analytical material taken from the site of company Admiral Markets, and the secondary publication on any other resources, the rights to intellectual property for a dealing center «Admiral Markets», the reference to the company site is obligatory.

About the Author

FX Empire editorial team consists of professional analysts with a combined experience of over 45 years in the financial markets, spanning various fields including the equity, forex, commodities, futures and cryptocurrencies markets.

Advertisement