Advertisement

Advertisement

Technical Outlook: Important JPY Pairs

By:

USDJPY Bounce from 118.00 triggered USDJPY’s gradual price improvement, as depicted by the short-term ascending trend-channel; however, the pair currently

USDJPY

Bounce from 118.00 triggered USDJPY’s gradual price improvement, as depicted by the short-term ascending trend-channel; however, the pair currently witnesses 121.40-50 horizontal-zone as important nearby resistance, breaking which 121.80, 61.8% Fibo of August decline, is likely an intermediate stop that it needs to clear before rallying towards 122.80, encompassing the said channel resistance line. Moreover, a sustained up-move beyond 122.80, may find 123.20, 76.4% Fibo, and the 124.00 mark as consecutive resistances. Should the pair failed to break 121.50 and reversed from the current level, as it did recently, 50% Fibo and the channel support, near 120.70, becomes an important support level for the pair trader to watch, breaking which the pair renew its downside towards 120.00 and the 38.2% Fibo, near 119.60. On a further downside below 119.60, the pair is likely to test 119.00, 118.50 and the current month lows of 118.00.

EURJPY

Even if the EURJPY plunged to the lowest levels in six months during last week’s plunge, it failed to close below the broader “Falling-Wedge” bearish formation support, also encompassing 61.8% Fibonacci of the pair’s April – June rally, near 131.75. However, short-term descending trend-line, connecting the recent highs, keep limiting the pair’s immediate upside, signaling another attempt by the pair to test the mentioned 131.75 important support level. If the pair breaks 131.75 on a closing basis, chances of it quick plunge to 130.60-50 can’t be denied, breaking which the 76.4% Fibo, near 129.50 becomes the following support for the pair. On the upside, a break above descending trend-line resistance, near 133.00 round figure mark, may click the pair’s tick to the 50% Fibo level of 133.50, breaking which 134.50 and the 38.2% Fibo, near 135.30, may provide the buffer to the pair’s upward trajectory before it could test the formation resistance, also including the 100-day SMA, near 135.80 – 136.00 area.

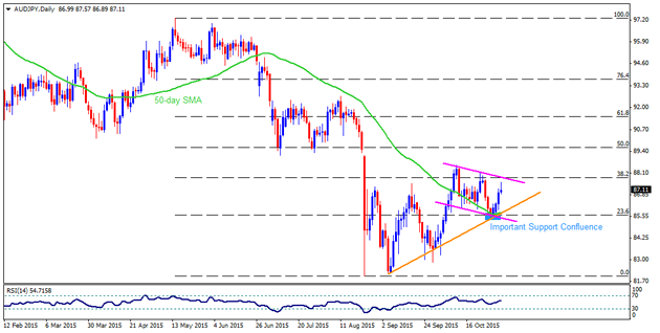

AUDJPY

Following its reversal from 85.60-50 support confluence, comprising 50-day SMA, 23.6% Fibonacci Retracement Level of the pair’s May – September decline, short-term descending trend-channel support and a month ascending trend-line support, the AUDJPY currently trades near a week’s high. However, the said channel resistance and the 38.2% Fibo, near 87.90, can limit the pair’s immediate rise. Should the pair manage to break 87.90, also closes above 88.00 round figure mark, the pair could rally to 88.60 and then to the 50% Fibo, near 89.50-60 resistance area. Meanwhile, 86.30 can act as immediate support for the pair, breaking which said 85.60-50 support confluence comeback becomes sure. Furthermore, the pair’s closing break of 85.50 can quickly pull the pair towards 85.00 mark prior aiming for 83.60-50 support area.

CADJPY

A close above four month old descending trend-line resistance, presently around 92.00, fueled the pair to test the highest levels in three weeks; though, the pair currently struggles near 38.2% Fibo of its June – August downside. Given the pair’s inability to sustain the break, coupled with the daily closing below 92.00, the recent breakout gets negated and the pair can again aim for 91.30 and the 23.6% Fibo near 90.50 mark. Further, extended declines below 90.50, also breaking the 90.00 can make the pair vulnerable enough to plunge towards 88.80-70 horizontal support area. Alternatively, successive close above 93.30 immediate resistance and the 100-day SMA level of 93.70, can fuel the pair’s upward trajectory towards 50% Fibo, 94.30. Should the pair manage to surpass 94.30 on a closing basis, it could rise towards 96.00 round figure mark.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement