Advertisement

Advertisement

Technical Update For AUD/USD, EUR/AUD & AUD/CAD: 03.11.2017

By:

AUD/USD With the support-turned-resistance line of 0.7730 restricting AUDUSD’s near-term upside, the pair seems declining to re-test recent low of 0.7625;

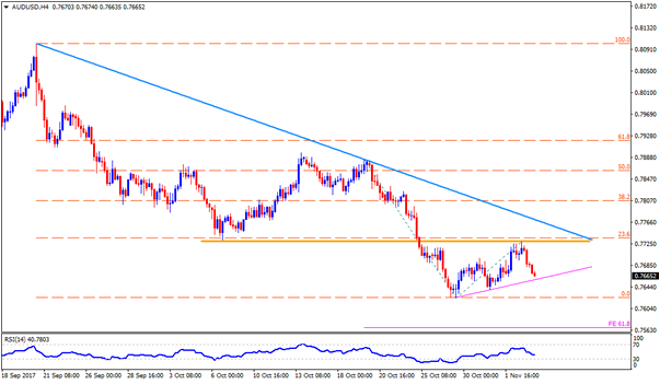

AUD/USD

With the support-turned-resistance line of 0.7730 restricting AUDUSD’s near-term upside, the pair seems declining to re-test recent low of 0.7625; however, break of an immediate ascending TL, at 0.7655 now, might act as a trigger for the pair’s drop. Should the quote extend its south-run beneath 0.7625, the 0.7600 round-figure and the 61.8% FE level of 0.7565 could appear on the chart. On the contrary, pair’s U-turn from 0.7655 can again propel prices towards 0.7700 and then to the 0.7730 horizontal-line, breaking which it can rise to a bit broader trend-line resistance of 0.7770. In case if buyers fuel the pair beyond 0.7770, the 0.7820 and the 0.7855 may become their favorite north-side numbers to watch.

EUR/AUD

EURAUD’s bounce from short-term ascending trend-line presently helps the pair to aim for the 1.5215 TL resistance, break of which could further escalate its recovery in direction to the 1.5235-40 horizontal-region. Given the upside momentum clears 1.5240 barrier, the 1.5280, the 1.5325 and the 1.5355 are likely consecutive levels that traders can target before looking at the October high of 1.5395 and the 1.5400 mark. Meanwhile, the 1.5120 could offer adjacent rest to the pair during its U-turn ahead of reigniting the importance of 1.5100 trend-line support, which if broken may activate the fresh selling wave aiming the 1.5070, the 1.5030 and then the 1.5000 psychological magnet. Moreover, pair’s sustained downturn below 1.5000 could well open the door for the 1.4945 and the 1.4900 supports.

AUD/CAD

Following its failure to surpass the 0.9905-10 resistance-confluence, the AUDCAD now tests the immediate “Rising-Wedge” Bearish formation support, at 0.9825, break of which can theoretically confirm its plunge below September low of 0.9680 by registering a figure around 0.9655-55. However, the 0.9800, the 0.9770 and the 0.9710 might become buffers for sellers to clear. Alternatively, 0.9860 seems nearby resistance for the pair to break in order to confront the 0.9905-10 zone, breaking which it can rally to 0.9925 and the 0.9960 resistances. If at all the buyers keep dominating the quote after 0.9960, chances of witnessing the 0.9975 and the 1.0000 mark can’t be denied.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement