Advertisement

Advertisement

Technical Update – CHF Pair

By:

USDCHF After moving back above 1.0100 mark post SNB shock, the pair resumed its downward trajectory and now seems to be trading in a well-established

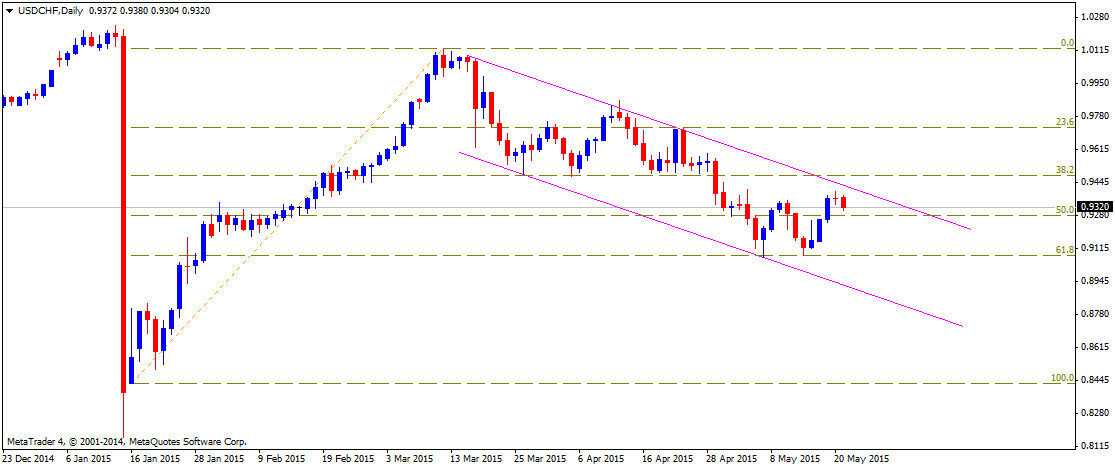

USDCHF

After moving back above 1.0100 mark post SNB shock, the pair resumed its downward trajectory and now seems to be trading in a well-established short-term descending trend-channel. The pair is currently trading just above 50% Fib. retracement level of its post SNB up-move. From current levels, the upper trend-line of the descending channel, near 0.9400-20 area, now seems to act as immediate strong resistance. Decisive strength above 0.9400 resistance and a subsequent strength above 38.2% Fib. retracement level resistance near 0.9480-85 level is more likely to lift the pair further towards retesting its next important resistance near 0.9720-30 area, marking 23.6% Fib. retracement level. Meanwhile a break below 0.7300-0.7280 zone, representing 50% Fib. retracement level, seems to add to the near-term weakness, initially towards testing 0.9160-50 horizontal support and eventually towards testing the very important support near 0.9080-70 area, marked by 61.8% Fib. retracement level. Moreover, a decisive break below 61.8% Fib. retracement level seems to have the potential to continue exerting pressure in the near-term and could drag the pair back below 0.9000 psychological mark support towards testing the lower trend-line support of the descending channel, currently near 0.8800 mark.

EURCHF

Following a recovery to 1.0800 mark, nearing 50% Fib. retracement level of the fall on the SNB decision day, the pair resumed its downward trajectory and is currently trading very close to a short-term ascending trend-line support, held since SNB fall. Also any up-move now seems to be restricted by a short-term descending trend-line. Both the ascending and descending trend-lines now seems form a symmetrical triangle, suggesting a sideways movement before resumption of the prior trend. Hence, a decisive break below this trend-line support, currently near 1.0370 level might trigger a sharp fall immediately towards testing 23.6% Fib. retracement level support near 1.0250 area. Meanwhile, a short-term descending trend-line resistance near 1.0460-70 zone seems to restrict any immediate up-move for the pair. A move above this trend-line resistance seems to immediately lift the pair back towards 1.0580-1.0600 resistance area, marked by 38.2% Fib. retracement level.

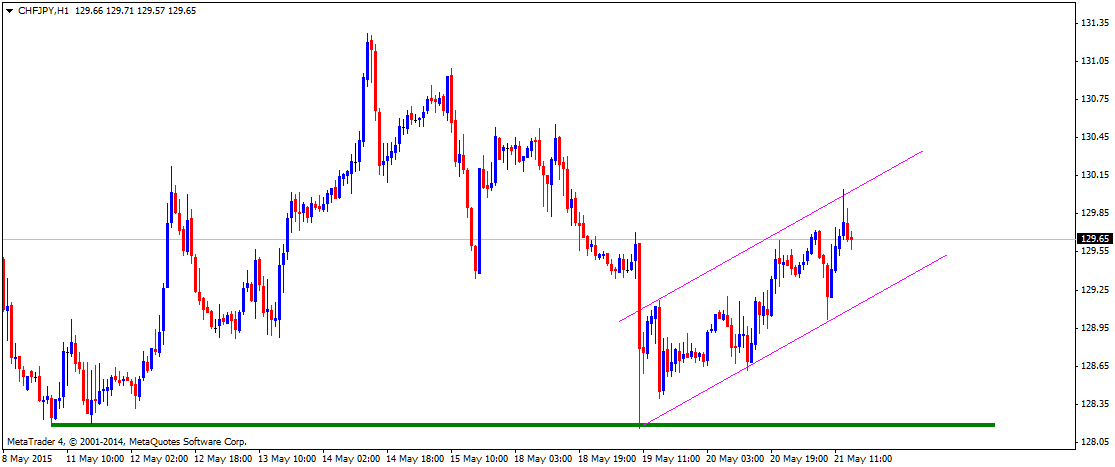

CHFJPY

Since the beginning of the month, the pair seems to oscillate within a broad trading range between 128.00 mark on the downside and 131.00 mark on the upside. Meanwhile on 1-hour chart, the pair seems to have moved in a short-term ascending trend-channel, possibly indicating a move higher initially towards testing the upper trend-line resistance of the channel, currently near 130.00 round figure mark, and eventually towards the top end of the trading range (131.00 mark resistance). On the downside, the lower trend-line of the ascending channel, currently near 129.20-129.00 zone, seems to protect immediate downside. Failure to hold this support seems to take the pair back towards testing the lower end of the trading range (128.00 mark support). Further near-term direction for the pair would be determined only once the pair manages to decisively break-out of the current trading range.

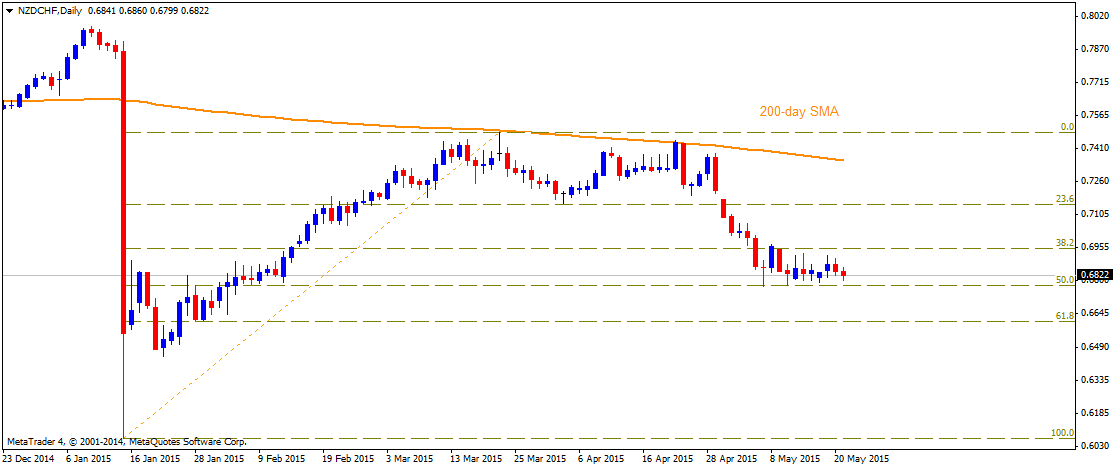

NZDCHF

The pair’s recovery from multi-year lows faced a strong headwind near 200-day SMA, reversing its gains to drop back to Feb. 2015 lows, also marked by 50% Fib. retracement level of the post SNB recovery move. Should the pair fail to hold this immediate support near 0.6775-70 area, it seems to continue drifting lower towards 61.8% Fib. retracement level support near 0.6610-0.6600 area. Alternatively, a bounce from current support levels and a subsequent strength back above 0.6880-0.6900 resistance area, seems to open room for extension of the up-move, even beyond 38.2% Fib. retracement level resistance near 0.6950 level and 0.7000 psychological mark resistance, towards 0.7070 horizontal resistance. The momentum could further lift the pair towards its next major resistance at 23.6% Fib. retracement level near 0.7140-50 region.

Follow me on twitter @Fx_Haresh for latest market updates

About the Author

Haresh Menghaniauthor

Advertisement