Advertisement

Advertisement

Technical Update – EURUSD, GBPUSD, USDJPY and NZDUSD

By:

EURUSD Extending its rebound from 1.0820 level, the pair on Tuesday managed to clear its immediate resistance near 1.1000 mark, nearing 50% Fib.

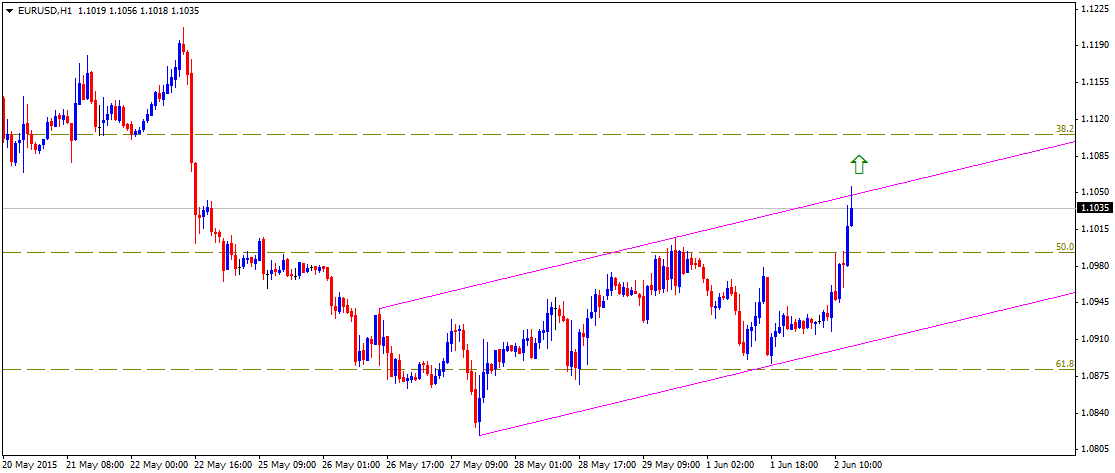

EURUSD

Extending its rebound from 1.0820 level, the pair on Tuesday managed to clear its immediate resistance near 1.1000 mark, nearing 50% Fib. retracement level of its April-may upswing. The pair currently is trading near 1.1040-50 resistance area representing the upper trend-line resistance of a short-term ascending trend-channel formation on 1-hourly chart. Sustained trade above 1.1050 now seems to clear way for continuing the up-move towards its next major resistance near 1.1100 mark, coinciding with 38.2% Fib. retracement level and nearing 100-day SMA. Further, a decisive strength above 100-day SMA has the potential to lift the pair back above 1.1200 mark towards 1.1240-60 resistance area, marking 23.6% Fib. retracement level. Meanwhile on the downside, 1.1000 mark representing 50% Fib. retracement level now seems to protect immediate downside. Weakness back below 1.1000 mark seems to contain the pair within the short-term ascending trend-channel, thus making it vulnerable to drop back towards testing the lower trend-line support of the channel, currently near 1.0900 region.

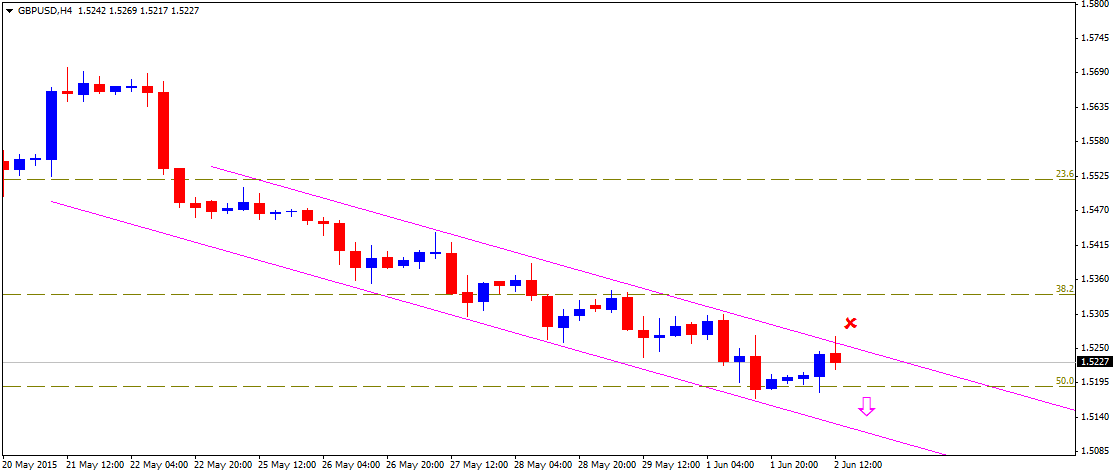

GBPUSD

The pair’s reversal from 1.5800 mark and a subsequent drop below 1.5500 mark negated its bullish momentum triggered post UK Parliamentary election result. The follow-up weakness drag the pair back below 1.5300 mark but held an intermediate support near 1.5180-70 zone, marked by 50% Fib. retracement level of its up-move from April lows to high touched in the month of May. Now on 4-hourly chart the pair seems to have moved within a short-term descending trend-channel, with immediate upside resistance pegged at the upper trend-line resistance, currently near 1.5270-90 area. Till the pair continues trading below 1.5300 mark, it seems vulnerable to break below 1.5180-70 support area and continue drifting lower towards testing its next important support near 1.5110-1.5100 mark, also coinciding with the lower trend-line support of the descending channel. Weakness below 1.5100 mark now seems to open room for continuing the near-term downward trajectory back below 1.5000 psychological mark support. Meanwhile, a move above 1.5270-90 resistance area is likely to confront immediate resistance at 38.2% Fib. retracement level, near 1.5340-50 area zone. Only a decisive move above 1.5300 mark and a subsequent strength above 1.5350 resistance level might negate the near-term bearish outlook for the pair, paving way to reclaim 1.5500 psychological mark resistance, also nearing 23.6% Fib. retracement level.

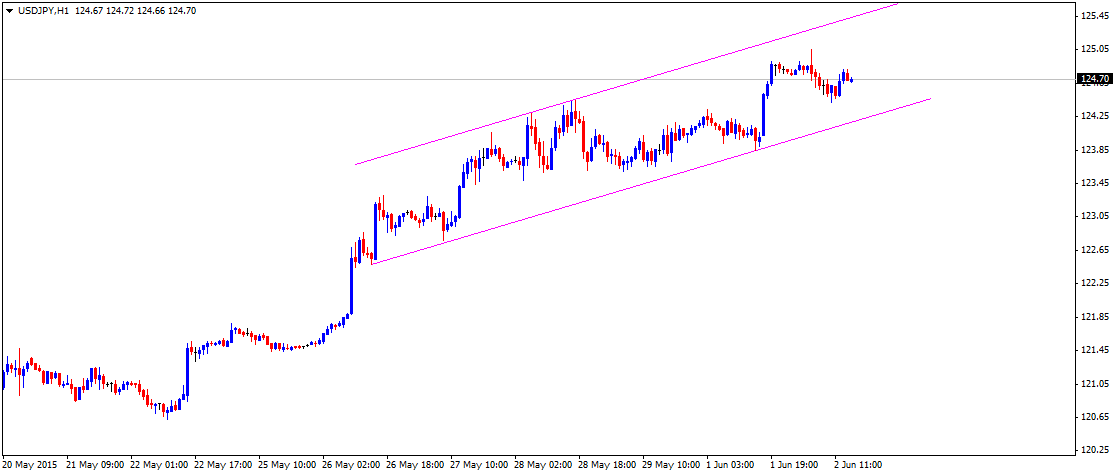

USDJPY

The pair on Tuesday momentarily moved above 125.00 mark, touching a fresh 12-year high, before retracing a bit to 124.40 level. On 1-hour chart, the pair has now moved within a short-term ascending trend-channel, suggesting a possible dart back towards 125.00 mark. Should the pair manage to move back above 125.00 mark, it seems to immediately head towards testing the upper trend-line resistance of the channel, currently near 125.45-50 area. Alternatively, should the pair starts witnessing some profit-taking move, it is likely to find immediate support at the lower trend-line support of the channel, currently near 124.20 level. Failure to hold the ascending trend-channel support now seem trigger some corrective move, immediately towards 123.60 horizontal support, before heading towards its next support near 123.00-122.80 area.

NZDUSD Following a break below 0.7250 level, the pair confirmed continuation of the downward momentum, also suggested by formation of a short-term descending channel on 4-hourly chart. However, the pair seems to have found some support near 0.7100 mark and is currently witnessing some pull-back from lower level. From current level, the upper trend-line of the descending channel, currently near 0.7175-80 area seems to act as immediate strong resistance. This resistance will come into play only if the pair manages to move above 0.7135-40 immediate horizontal resistance. Strength above 0.7175-80 resistance area now seems to trigger some relief rally for the pair towards an important support now turned resistance near 0.7290-0.7300 zone. Meanwhile, a drop below 0.7100 mark now seems to accelerate the downfall towards testing the lower trend-line support of the descending channel, currently near 0.7030-20 area, before making an attempt to test the very important 0.7000 psychological mark, level not tested since August 2010.

Following a break below 0.7250 level, the pair confirmed continuation of the downward momentum, also suggested by formation of a short-term descending channel on 4-hourly chart. However, the pair seems to have found some support near 0.7100 mark and is currently witnessing some pull-back from lower level. From current level, the upper trend-line of the descending channel, currently near 0.7175-80 area seems to act as immediate strong resistance. This resistance will come into play only if the pair manages to move above 0.7135-40 immediate horizontal resistance. Strength above 0.7175-80 resistance area now seems to trigger some relief rally for the pair towards an important support now turned resistance near 0.7290-0.7300 zone. Meanwhile, a drop below 0.7100 mark now seems to accelerate the downfall towards testing the lower trend-line support of the descending channel, currently near 0.7030-20 area, before making an attempt to test the very important 0.7000 psychological mark, level not tested since August 2010.

Follow me on twitter @Fx_Haresh for latest market updates

About the Author

Haresh Menghaniauthor

Advertisement