Advertisement

Advertisement

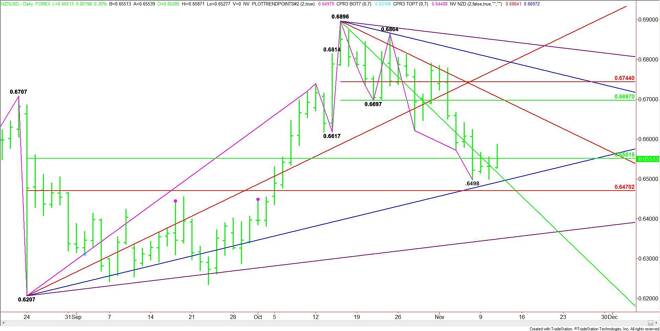

The Best Trading Opportunity Today – NZD/USD – November 11, 2015

By:

The NZD/USD is trading better, underpinned by the Reserve Bank of New Zealand’s financial stability report that led investors to believe a rate cut is

The NZD/USD is trading better, underpinned by the Reserve Bank of New Zealand’s financial stability report that led investors to believe a rate cut is less imminent. According to the central bank, “there is less scope for monetary policy easing to offset a sharp rise in funding spreads.” It also mentioned that the transmission of monetary policy may be affected by a lack of participants in the FX swap market and banks have lower risk appetite.

The statement went on to say that the central bank was concerned about a potential drop in housing prices and lower demand for dairy.

The NZD/USD caught a bid after the report. Since the trend is down, this was likely short-covering. There are no major economic reports today, but it is a U.S. bank holiday so volume and volatility is expected to be lower. The conditions, however, could trigger sizeable reactions by aggressive traders, trying to take advantage of the light trading conditions.

The main trend is down according to the daily swing chart. The main range is .6207 to .6896. Late last week, the NZD/USD found support inside this range at .6498. After two days of consolidation inside the zone, the market is straddling the upper or 50% level of the range at .6551. Trader reaction to this zone is likely to set the tone for the day.

A short-term range is forming between .6896 and .6498. A sustained move over .6651 will indicate the presence of buyers. This could create enough upside momentum to trigger a surge to the upside. Based on the short-term range, its 50% level at .6697 is the primary upside target. Another target is a downtrending angle at .6706.

A sustained move to the downside will signal the presence of sellers. Losses are likely to be limited by last week’s low at .6498 and a long-term uptrending angle at .6492.

If volatility and volume return today then look for a sustained breakout over .6551. Earlier in the session the market broke out over this level, but the move was stopped at .6587. Buyers are trying to re-establish support at .6551. If they succeed then look for the start of a strong rally.

Watch the price action and order flow at .6551 today. Look for a buying opportunity on a sustained move over this level. When assessing the risk of trading the long side today, keep in mind that this is a counter-trend trade. The set-up is there, but it is going to take rising volume to make it work.

Look for a selling opportunity on a sustained move under .6551 but look for a labored move because of potential support levels at .6492 and .6470.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement