Advertisement

Advertisement

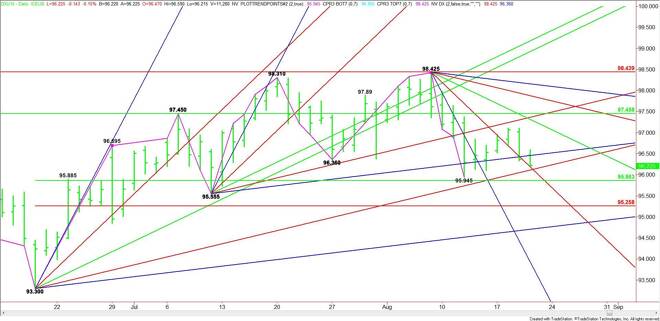

US Dollar Index (DX) Futures Technical Analysis – August 20, 2015 Forecast

By:

September U.S. Dollar Index futures are trading lower in the pre-market session. The selling started on Wednesday following the release of the latest Fed

September U.S. Dollar Index futures are trading lower in the pre-market session. The selling started on Wednesday following the release of the latest Fed minutes from the July monetary policy meeting.

The main trend is down according to the daily swing chart. The current down side momentum suggests sellers may go after the last low at 95.945. Taking out this level will reaffirm the downtrend.

Based on the current price at 96.22, the next downside target is a price cluster at 96.18 to 96.11.

The main range is 93.30 to 98.425. Taking out 96.11 is likely to drive the market into its 50% level at 95.86. The daily chart opens up to the downside under this angle, making it a trigger point for an acceleration. The next major target is a Fibonacci level at 95.26.

The Fibonacci level at 95.25 is also a trigger point for an acceleration to the downside with the next target a long-term uptrending angle at 94.71.

Overcoming the uptrending angle at 96.46 will signal the presence of buyers. This could trigger the start of a short-covering rally with the next target a downtrending angle at 97.30.

Look for a bearish bias on a sustained move under 96.11 and a bullish tone on a sustained move over 96.46.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement