Advertisement

Advertisement

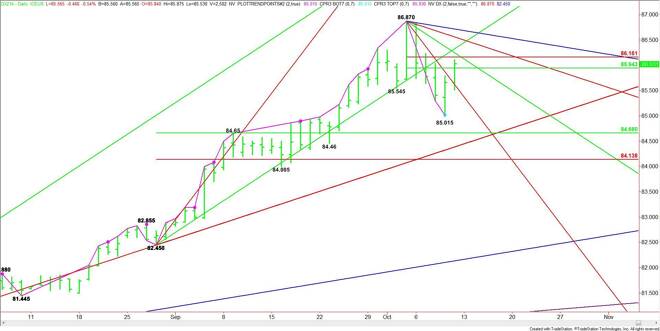

US Dollar Index (DX) Futures Technical Analysis – October 13, 2014 Forecast

By:

December U.S. Dollar Index futures followed through to the upside on Friday, following the previous day’s closing price reversal bottom. The short-term

December U.S. Dollar Index futures followed through to the upside on Friday, following the previous day’s closing price reversal bottom.

The short-term range is 86.87 to 85.015. The retracement zone of this range, which was the upside target, was reached on Friday. This zone is important because the market will either blow through it on the way to a new top, or fail inside it, setting up a potentially bearish secondary lower top chart pattern.

A downtrending angle at 86.12 passes through the retracement zone, making it a valid target. This is followed by additional angles at 86.50 and 86.68.

Crossing back under a steep downtrending angle at 85.37 will be a sign of selling pressure. Taking out 85.015 will negate the closing price reversal bottom.

The main range is 82.45 to 86.87. Its retracement zone at 84.66 to 84.14 is the next major downside target. A major uptrending angle passes through this zone at 84.45, making it a valid downside target.

The tone of the day will be determined by trader reaction to the pivot at 85.94 to 86.16. Look for a bullish tone to develop if buyers can hold the index above 86.16. And a bearish tone on a sustained move through 85.94.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement