Advertisement

Advertisement

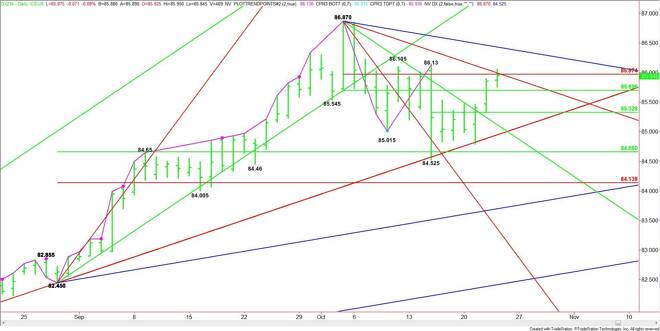

US Dollar Index (DX) Futures Technical Analysis – October 24, 2014 Forecast

By:

September U.S. Dollar Index futures closed higher on Thursday and in a position to challenge the last main top at 86.13. A trade through this level will

September U.S. Dollar Index futures closed higher on Thursday and in a position to challenge the last main top at 86.13. A trade through this level will turn the main trend to up on the daily chart.

The main range is 86.87 to 84.525. The retracement zone of this range at 85.70 to 85.97 is currently being tested. A downtrending angle from the 86.87 top drops in at 85.93. This angle forms a resistance cluster with the Fibonacci level at 85.97, making it an important area to watch today.

If there is no rally on the opening then 85.93 to 85.97 is likely to be resistance today. However, if there is a breakout to the upside then look for buyers to go after the top at 86.13 and the next downtrending angle at 86.40. The next angle drops in at 86.64. This is the last angle before the contract high at 86.87.

A failure to take out 85.97 will signal that sellers are in the market. If this creates downside momentum then look for a drive into the 50% level at 85.70. The index could accelerate to the downside if this price is taken out with better-than-average volume, making 85.33 the next likely downside target.

The tone of the market today will be determined by trader reaction to the Fib level at 85.97.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement