Advertisement

Advertisement

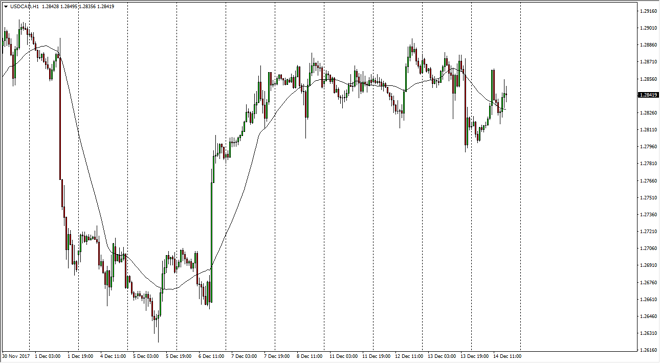

USD/CAD Price Forecast December 15, 2017, Technical Analysis

Updated: Dec 15, 2017, 06:28 GMT+00:00

The US dollar was noise ANC Canadian dollar during the session on Thursday again, as we continue to hover around the 1.2850 region. I believe that if we can break above the 1.29 handle, the market can go much higher.

The US dollar rallied a bit during the trading session on Thursday, spiking to the 1.2870 level, before pulling back again. I think that the epicenter of the market is the 1.2850 handle, and if we can break above the 1.29 level, the market can go much higher. There is the usual correlation to crude oil, so if it starts falling rather hard, this pair will of course take off to the upside. Beyond that, there is also the specter of higher interest rates in the United States as compared to Canada, so I think it’s only a matter of time before this market does rally. If we do break down from here, I think that the 1.27 level would be massively supportive. In fact, I do not believe that the market can be sold easily until we break down below the 1.25 handle, which would be a complete capitulation of the recent bullish pressure.

The Canadian economy also is dealing with a massive housing bubble in the Ontario province, most specifically around the Toronto area. This is a massive amount of the value of the Canadian economy, so this of course will be a situation that people were paying attention to. Overall, the market will remain volatile and choppy, but I believe that the buyers will continue to jump into this market, as there are far too many questions when it comes to the Canadian economy, and of course crude oil which will have its influence as per usual. Longer-term, I anticipate that we are looking at a move towards the 1.30 level.

USD/CAD Video 15.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement