Advertisement

Advertisement

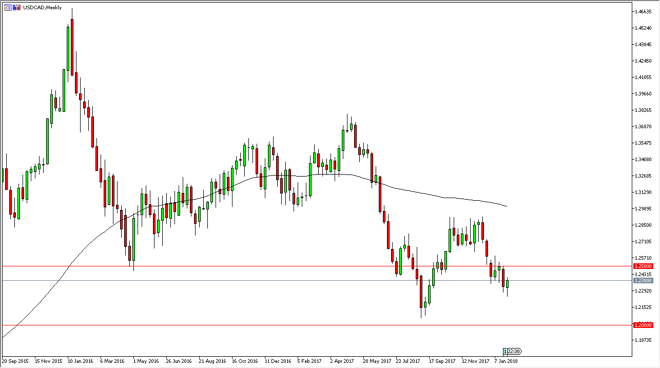

USD/CAD Price forecast for the week of September 5, 2018, Technical Analysis

Updated: Feb 3, 2018, 05:51 GMT+00:00

The US dollar has initially fallen during the week but has shown signs of strength to turn around and form a hammer. The hammer of course is a very bullish sign, but I think that the 1.25 level above is very important. There’s also a gap just above there that will continue to put pressure on the market to the downside, so I think the next several of weeks should be very interesting.

The US dollar has initially fallen during the week but turned around to form a bit of a hammer. The hammer show signs of potential support, and I think that if we were to break down below the bottom of the hammer, that would be a very negative sign indeed. At that point, I would anticipate a return to the 1.21 handle, perhaps even the 1.20 level. Obviously, there is the usual correlation between the Canadian dollar in the oil markets, as this pair tends to drop when the oil markets rally.

On the other hand, there is the gap above the 1.25 level, so we would need to clear the top of the shooting star from 3 weeks before to buy this market and reach towards the 1.2850 level. If we do rally, this will be a “higher low”, which of course is a very bullish sign. I believe that this market is going to remain very volatile over the next several weeks, so keep in mind that short-term trading is probably the best way to go when it comes to this pair. Oil will lead the way, so pay attention to it as it has been explosive as of late, and of course has driven this pair down rather drastically over the last several weeks.

USD/CAD Video 05.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement