Advertisement

Advertisement

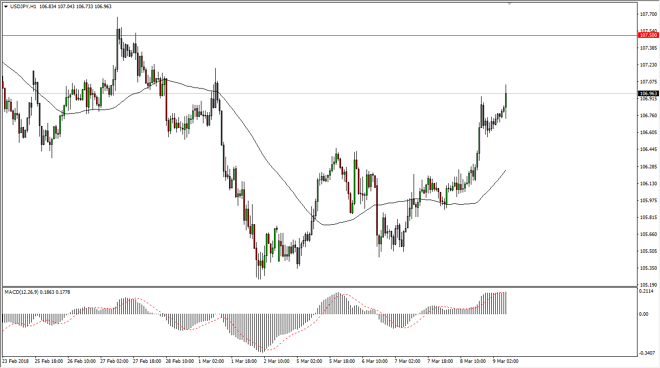

USD/JPY Price Forecast March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 06:51 GMT+00:00

The US dollar initially dipped during the trading session on Friday but found enough support near the 106.60 level to turn around and bounce. This of course helped by the stronger than anticipated jobs number coming out of the United States for February, with a result of 313,000.

The US dollar rallied a bit during the day on Friday, reaching towards the 107 handle. I believe that the market is going to try to get to the 107.50 level above, which is resistance. That’s an area that has been important more than once, so I don’t think we break through it right away, but eventually we could. If we can break above the 107.50 level, then the market goes to the 110 level after that. I believe that short-term pullbacks will offer value, if we can stay in the “risk on” mode that we have seen as of late. We have also recently made a “higher low”, and that show signs of a bottom.

The 105 level underneath features not only a sideways support level, based upon not only structural support, but psychological support, but also a massive uptrend line. That massive uptrend line should continue to be the “floor” in the overall market. I think that given enough time, the market should continue to go towards the 110 handle but it’s going to take a lot of momentum and good news to continue that to happen. The geopolitical issues continue to be a major driver of where this pair goes, as we are worried about trade wars, geopolitical concerns, and many other issues. At this point, it looks as if the buyers are going to continue to look at this is a potential value. With that in mind, I not only am willing to serve buying this pair, but I like adding as the market works in my favor.

USD/JPY Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement