Advertisement

Advertisement

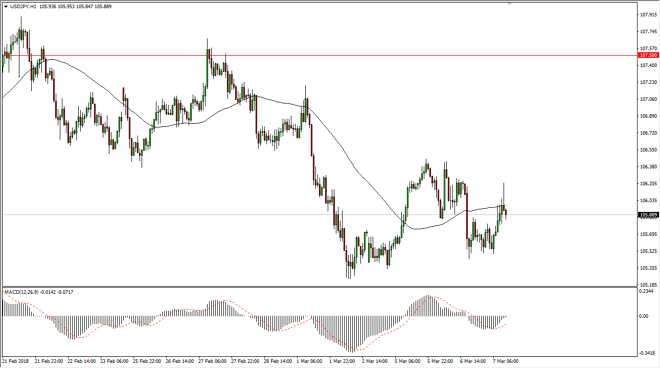

USD/JPY Price Forecast March 8, 2018, Technical Analysis

Updated: Mar 8, 2018, 05:09 GMT+00:00

The US dollar was bullish against the Japanese yen during trading on Wednesday, which was a bit ironic considering how shaky most stock markets around the world were. At this point, it looks like we continue to consolidate overall.

The US dollar has rallied against the Japanese yen during trading on Wednesday, reaching towards the 106.25 region. I see a significant amount of resistance at 106.50, so it’s not until we break above there that I feel the market can continue the upward climb towards the 107.50 region above which is my target short term. In the meantime, we could very well pull back and I look at the 105.50 level underneath as support that extends down to the 105 handle, and somewhat of a “zone.”

The market is typically very sensitive to risk appetite, so in general it’ll be interesting to see how that plays out as there are a lot of concerns about trade wars between various countries around the world suddenly, something the quite frankly I’m surprised hasn’t flared up previously. In the meantime, I think the US dollar is starting to see strength overall, and that is starting to influence this pair, although the Japanese yen is most certainly a safety currency. At this point, I believe that the 107.50 level is the longer-term target, but it is going to take a lot of effort to get there. Currency markets in general look kind of tight right now, and the US dollar against the Japanese yen doesn’t look to be any different.

If we were to break down below the 105 handle, that would be very negative for this market, because it would not only breakthrough a large, round, psychologically significant number, but it would also have sliced down through a major uptrend line, opening the door to the 100 handle.

USD/JPY Video 08.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement