Advertisement

Advertisement

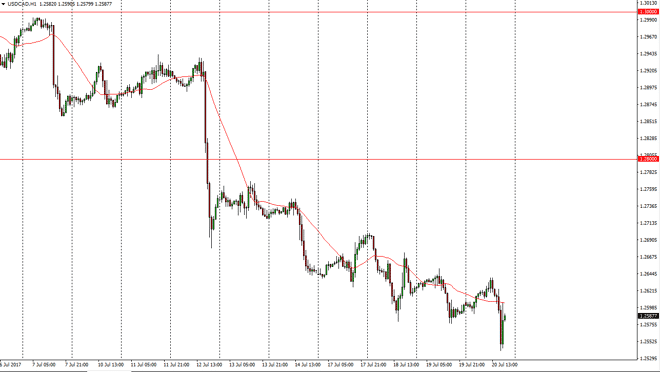

USD/CAD Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:27 GMT+00:00

The US dollar fell below the 1.26 level after initially tried to rally on Thursday. We found support below, and it now looks as if we are going to

The US dollar fell below the 1.26 level after initially tried to rally on Thursday. We found support below, and it now looks as if we are going to continue to “sell the rallies” in general. Because of this, I believe that the market should continue to be one that’s bearish, but I don’t necessarily think that we are going to see a massive move in one fell swoop. Quite frankly, the oil markets rolled over, and that give us a little bit of support in this market, but I believe the market will continue to look towards the 1.25 level as it is a much more interesting level. I have no interest in buying this market until we would break well above the 1.28 handle, so likely selling pressure will continue in my eyes. I believe that the 1.25 level below will be massively supportive though, because of the psychological nature.

Selling rallies

I believe that rallies are to be sold, and short-term trading opportunities will continue to present themselves. I think the you can pick up 30 or 40 pips at a time, and because of this you may want to look to the hourly charts to make your trading decisions going forward. The market should continue to see volatility, but I certainly think that there is more bearish pressure than bullish, as we have been in a reasonably reliable downtrend sends the tank of Canada has decided to raise interest rates. The bond market trade continues to favor the Canadians as well, so I think it’s only a matter of time before we fall on every rally as the market seems all but resigned to at least the 1.25 handle, if not lower levels than that. For now, it seems that the housing crisis in Canada is being ignored.

USD/CAD Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement