Advertisement

Advertisement

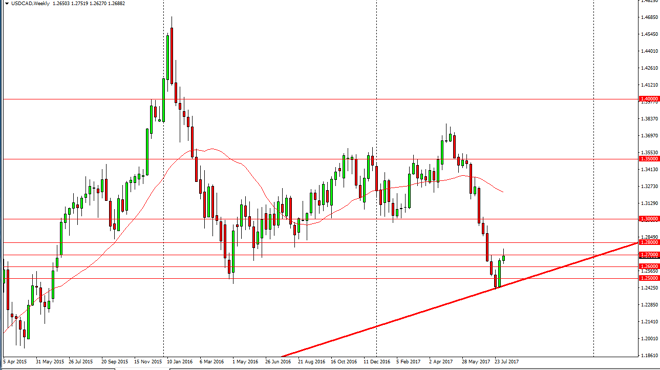

USD/CAD forecast for the week of August 14, 2017, Technical Analysis

Published: Aug 12, 2017, 04:29 GMT+00:00

The US dollar rallied during the week against the Canadian dollar, but continues to struggle at the 1.27 handle. We did a forming a bit of a shooting

The US dollar rallied during the week against the Canadian dollar, but continues to struggle at the 1.27 handle. We did a forming a bit of a shooting star, and this could cause a bit of a pullback. That would not be a huge surprise though, but I believe that the pullback is probably going to only offer a buying opportunity at lower levels. The uptrend line on the weekly chart has held, and we have had a massive and impulsive candle formed for the previous week. Ultimately, I believe that short-term pullbacks offer value the people will take advantage of, and a break above the top of the shooting star from the week, that’s even more bullish. Eventually, I suspect that the market will go looking towards the 1.30 level above, but it may take some time to get there.

The bond trade

The bond trade that has been going on has unwound. Recently, people have been buying Canadian bonds in shorting American ones. This of course drives money back and forth across the border, which affects the Forex markets. I believe given enough time this trade is going to, completely unwound, as the Canadian employment situation disappointed this month. Also, the long-term uptrend line has held, and that certainly will catch a lot of people’s attention. The 1.30 level above will be a round target that a lot of people will be paying attention to, but it may take some time to get there. If we did breakdown below the trendline, that of course would be very negative and could send this market into a major downtrend. Currently, I think that there is much more opportunity to the upside then down, but pulling back and offering a bit of value isn’t the worst thing.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement