Advertisement

Advertisement

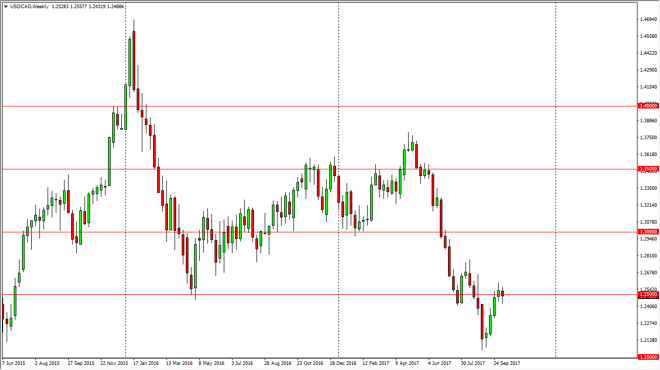

USD/CAD forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:31 GMT+00:00

The US dollar fell during the bulk of the week, finding support at the 1.25 handle. By doing so, the market has formed a hammer, and it looks as if the US

The US dollar fell during the bulk of the week, finding support at the 1.25 handle. By doing so, the market has formed a hammer, and it looks as if the US dollar is trying to gain against the Canadian dollar. If the oil markets roll over, that should exacerbate the move, and we should go much higher. What I find interesting about this market is that after the surprise interest rate hike by the Bank of Canada, the market collapsed. However, since then we have not only bounced and firmed up pricing for the greenback, we have completely wiped out the losses. By taking the losses back almost immediately, that is a very bold statement. I think that if we can break above the highs from the previous week, the market will then go grinding its way towards the 1.28 handle, and then eventually the 1.30 level.

Alternately, if we were to break down below the hammer for the week, we could go looking towards the 1.21 level below. That would coincide with stronger oil markets, and by stronger, I mean much stronger. I think there is a bit of resistance just above current levels over there, so I think the knock-on effect from that region is probably going to be minimal. Interest rates in the United States continue to rise overall, and if that’s going to continue to be the case, that reverses the bond trade that we had seen break this market down late summer. Once that happens, there’s not much to keep this market rallying significantly. With oil markets being in as much trouble as they are longer-term, I think that the Canadian dollar is going to have a bit of trouble ahead of itself.

USD/CAD Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement