Advertisement

Advertisement

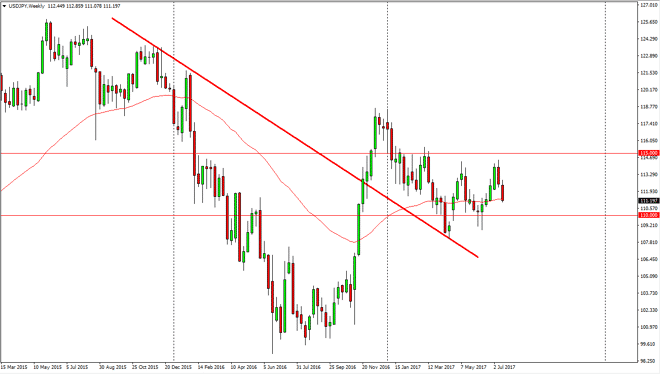

USD/JPY forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:42 GMT+00:00

The USD/JPY pair fell during the week, slicing through the 112 level rather handily. The market looks likely to find support at the 110 handle though, and

The USD/JPY pair fell during the week, slicing through the 112 level rather handily. The market looks likely to find support at the 110 handle though, and I think that buyers will continue to be attracted to this level, and I’m willing to buy close to the 110 handle. I believe that a supportive candle will present itself that we can start buying. The market could very well bounce from there and reach towards the 114.50 level above. A break above the 115 handle would signify that were going to go much higher, but there is a lot of work to be done between now and then. Once we do break above the 115 handle, the market should then go looking for the 118.50 level. I still believe in the uptrend, and I believe that the Federal Reserve will continue to raise interest rates going forward, regardless of what some pundits may think.

Waiting for support

I’m waiting for support in this market, so therefore I will be very patient and waiting on a signal to start going long. Shorting is possible for shorter-term traders, but for myself I believe that there are much more in the way of rewards by being patient and waiting for the longer-term move closer to the 110 level. If we were to break down below the 109 level, then I think all bets are off and we will break down significantly. However, I think that’s very unlikely in this market going forward.

USD/JPY Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement