Advertisement

Advertisement

USD/JPY forecast for the week of June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:14 GMT+00:00

The USD/JPY pair fell initially during the week, but found enough support underneath the 110 level to turn around and form a hammer. The hammer of course

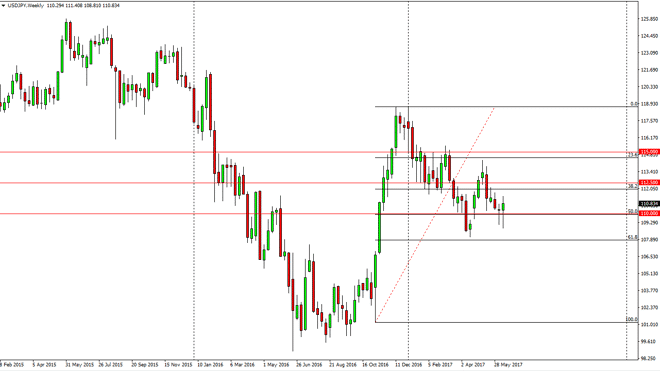

The USD/JPY pair fell initially during the week, but found enough support underneath the 110 level to turn around and form a hammer. The hammer of course is a very bullish sign, and a break above the top of the candle should send this market much higher. I think that the first target will be the 112 level, and then eventually the 115 level above. I think the fact that we have formed 2 hammers in a row on the weekly chart suggests that we are looking to see strength in the market. This will of course be a market that is reacting to the Federal Reserve and the more hawkish than expected stance. Because of this, the market should continue to go to the upside and favor the US dollar as the Bank of Japan is obviously miles away from doing anything even remotely looking like hawkish behavior.

Buying pullbacks

Longer-term, I believe in buying pullbacks, and that’s what we’ve seen, a pullback. We reach to the 61.8% Fibonacci retracement level, and then bounced all the way to the 114.50 level. We pull back from there, reaching towards the 50% Fibonacci retracement level, and now we have made a “higher low” from what I can see so far. After all both hammers suggest the same thing. I think that you’re going to have to deal with quite a bit of volatility, but given enough time it’s likely that the so-called “smart money traders” should continue to favor this market, and they are probably slowly building up larger positions as the overall trend change tends to be a messy affair, and I believe that we are seeing in a longer-term trend change after the impulsive move at the end of last year.

USD/JPY Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement