Advertisement

Advertisement

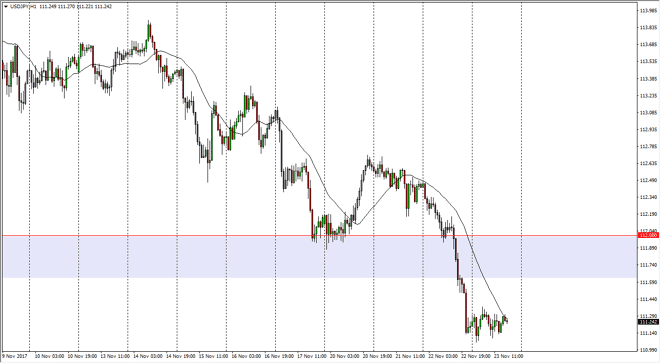

USD/JPY Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:05 GMT+00:00

The US dollar did very little against the Japanese yen on Thursday, as American celebrated Thanksgiving. We are sitting just above the 111 level, which is

The US dollar did very little against the Japanese yen on Thursday, as American celebrated Thanksgiving. We are sitting just above the 111 level, which is a bit of a psychological barrier, but breaking down significantly below the 112 level for me was the bigger story here, as it was supportive, but quite frankly we are in a much longer-term consolidation area between 114.50 and 108. I think this point, a breakdown below the 111 level simply said means that were to go down to the 110 level next, and then perhaps a bounce to offer another rally to sell. It is not until we break above the 112 level that I’m willing to buy this pair currently, although I recognize that a buying opportunity near the 108 handle would be excellent.

That’s not to say that it won’t be volatile on the way down, and most certainly will be as this pair is highly influenced by risk appetite, but quite frankly I think a lot of what is working here is that people are disappointed by Congress and its inability to pass a tax bill. That’s one of the major reasons why the Republicans have control of both houses, and quite frankly the fact that they could not get it done is a bit perplexing. That weighs upon the US dollar, and it’s not until we get some type of substantial reform, or some other type of catalyst that this market will rally. I believe that sets up for a nice pullback, and a return to the bottom of the consolidation now that we have broken through the technical support at the 112 level. In general, this is a market that will remain volatile, but I think it’s likely we will see more selling than buying.

USD/JPY Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement