Advertisement

Advertisement

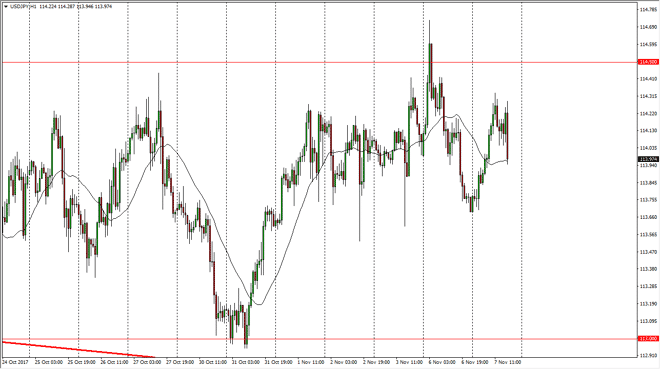

USD/JPY Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 05:27 GMT+00:00

The US dollar rallied initially during the day against the Japanese yen on Tuesday, reaching towards the 114.30 level. However, we are pulling back

The US dollar rallied initially during the day against the Japanese yen on Tuesday, reaching towards the 114.30 level. However, we are pulling back slightly, as I record this. Overall, I believe that the market continues to try to break above the 114.50 level above, which is the beginning of massive resistance in the pair, extending to the 115 handle. If we can break above that level, then the market goes much higher, as it would be a significant break out to the upside and should be a nice buying opportunity. Overall though, I think that it will take several attempts to break out to the upside, so I look at this is a “buy on the dips” market, but for short-term trading only. Eventually, I think we break out to the upside, and that of course could send this market higher in very short order.

If we do pull back from here, I believe that the 113.50 level underneath should be supportive, and most certainly the 113 level should. With this being said, I have no interest in selling this market, and I believe that we will eventually find buyers regardless what happens. Overall, I am a buyer and I believe that the rising interest rates in the United States should continue to push this market to the upside against the Japanese yen, which of course has a central bank that is very unlikely to do anything to tighten monetary policy. The markets continue to be choppy, so using a range bound base system could be the best way to go, perhaps stochastics or some other type of indicator thrown on top of a price action system may be the best way to take advantage of this building of upwards pressure.

USD/JPY Video 08.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement