Advertisement

Advertisement

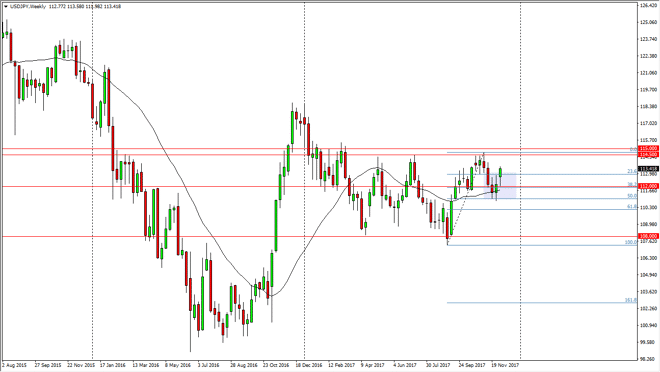

USD/JPY Price forecast for the week of December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:11 GMT+00:00

The US dollar broke above the 113 handle this week, a very bullish sign indeed.

The US dollar gapped higher at the beginning of the week, and then rolled over to test the 112 level for support. By filling the gap and then bouncing, the market has rallied significantly and after a print of 228,000 jobs for the month of November, the US dollar has rallied again. Now that we have broken above the 113 level, it is very likely that this market will go towards the 114.50 level above which is a significant resistance barrier that extends to the 115 handle. A close above there is more of a “buy-and-hold” scenario. When I look at this chart, it seems to me that we are in fact trying to form a bit of a base, but this pair tends to be rather choppy and noisy. I think there are plenty of things that can slam the market in both directions, so keep in mind that smaller position sizes are necessary.

If we were to break down below the 112 level, then I think we go looking towards the 50% Fibonacci retracement level at the 111 level again. I think that the market is very likely to see more bullish pressure than bearish, so I look at the pullbacks as a potential buying opportunity and more importantly, potential value in the greenback. Ultimately, I think that we do breakout to the upside but it’s going to take several attempts. Keep in mind that this pair is highly sensitive to risk, but with the Federal Reserve looking likely to raise interest rates this month, a lot of attention will be paid to the tone of the accompanying statement, and if they are hawkish it’s very likely that we continue to go higher in this pair.

USD/JPY Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement