Advertisement

Advertisement

Weekly Technical Outlook: GPB/USD; Market Forecasts for December 12th – December 16th

Published: Dec 13, 2016, 09:31 GMT+00:00

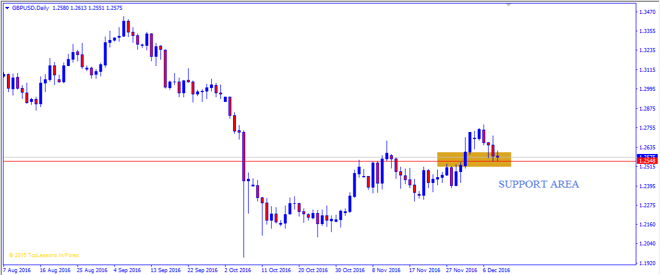

Resistance level 1.278104, 1.286315, 1.291313 Pivot Level 1.26168 Support Level 1.25479 Technical Analysis The GBPUSD pair closed weekend trading above

- Resistance level 1.278104, 1.286315, 1.291313

- Pivot Level 1.26168

- Support Level 1.25479

Technical Analysis

The GBPUSD pair closed weekend trading above 1.25479 levels, to get good support base that reinforces the expectations of continuing the bullish bias and provides signals for the price recovery in the upcoming days.

This is supported by stochastic positivity that appears clearly on the daily time frame and rises above 43.0 levels. The pair remains bullish for the moment with the pair trading on rebound after testing barriers, and that makes the trading settle at the support area that appears in the chart.

Some consolidations would be seen with bullish momentum and further rise is expected from current levels on the newfound support area.

With the beginning of the new trend, the first main target located at 1.278104 levels, pointing that breaking 1.286315 levels besides holding above it will push the price to being bullish that its next target located at 1.29131 levels.

Economic

- BoE Asset Purchase Facility, BoE Interest Rate Decision

- BOE MPC Vote Hike, BOE MPC Vote Unchanged, BoE Interest Rate Decision

- Retail Sales ex Autos, Retail Sales control group, FOMC Economic Projections

- Fed’s Monetary Policy Statement, Fed Interest Rate Decision, FOMC Press conference

- Building Permits Change, Baker Hughes US Oil Rig Count

Area of Interest

- Strong support at 1.25479 areas and closed above rebound of trend line.

- Bullish momentum above the support area.

- Price action closed above rebound of trend line and oscillator rising above 43.0 levels indicating shift in momentum.

- At Flip Area on Daily time frame support levels.

For more detailed analysis from the author, please visit NoaFX.

About the Author

Sylvester Stephencontributor

Advertisement