Advertisement

Advertisement

Weekly Technical Outlook: USD/JPY; Market Forecasts for August 29th – September 2nd

Updated: Aug 29, 2016, 10:12 GMT+00:00

Resistance level 103.9352, 105.3852, 106.3890 Pivot Level 100.6449 Support Level 99.9757 Technical Analysis The USDJPY pair closed weekend trading above

- Resistance level 103.9352, 105.3852, 106.3890

- Pivot Level 100.6449

- Support Level 99.9757

Technical Analysis

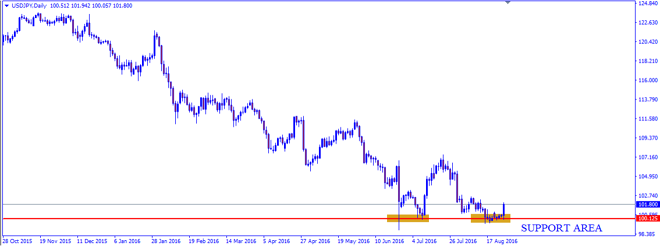

The USDJPY pair closed weekend trading above 99.9757 levels in order to get a good support base that reinforces the expectations of continuing the bullish bias and providing signals for the price recovery in the upcoming days.

This is supported by stochastic positivity that appears clearly on the daily time frame and seen rising above 58.0 levels.

The pair remains bullish for the moment with pair trading on rebound and that makes the trading settle at the support area that appears in the chart.

Some consolidations would be seen with bullish momentum and further rise is expected from current levels with price action signaling engulfing bar reversal on the new found support area.

With the beginning of USD trend, the first main target is located at 103.9532, pointing that breaking 105.3852 levels besides holding above that level will push the price to resume being bullish with its next target located at 106.3890.

Economic

- Consumer Confidence, ADP Employment Change, Initial Jobless Claims

- ISM Manufacturing PMI, ISM Prices Paid

- Unemployment Rate, Nonfarm Payrolls, Trade Balance

- Unemployment Rate, Jobs/applicants ratio, Overall Household Spending

- Large Retailer’s Sales, Retail Trade, Industrial Production, Foreign bond investment

Area of Interest

- Strong support at 99.9757 areas and closed above rebound of trend line.

- Bullish engulfing bar reversal strongly closing above the support area.

- Price action closed above rebound of trend line and oscillator rising above 58.0 levels indicating shift in momentum.

- At Flip Area on Daily time frame support levels.

For more detailed analysis from the author, please visit NoaFX.

About the Author

Sylvester Stephencontributor

Advertisement