Advertisement

Advertisement

WTI Gains $1.0 on Soft US CPI Figures; Gold Fails to Hold Above $1,800 as Investors Favor Risk Assets

By:

Softer than expected US inflation figures gave commodities a boost on Wednesday via a weaker buck.

Key Points

- WTI rose around $1.0 on Wednesday, pulled higher amid a broader risk asset rally after softer-than-expected US inflation figures.

- Upside was capped on news of a restart of oil flows through the Druzhba pipeline and mixed US inventories.

- Copper and gold both hit new one-month highs, though gold eventually turned lower, weighed amid risk-on flows.

WTI Rally Capped by Druzhba Oil Flow Restart

Front-month futures contracts of the US benchmark for sweet light crude oil, West Texas Intermediary or WTI, rose around $1.0 on Wednesday, pulled higher amid a broader risk asset rally as softer-than-expected US inflation figures stoked hopes about US inflation having peaked and eased concerns about excessively aggressive Fed tightening in the coming quarters. WTI ended Wednesday’s session near $91.50, a decent comeback from earlier intra-day lows under $88 per barrel.

The US dollar, with which oil prices have a negative correlation, was on course for its worst day in a month on Wednesday, with the DXY last down around 1.0%. Analysts said that a decline of this magnitude would normally see WTI gain between $2-$3 barrels on the day. News of a resumption of oil flows via the portion of the Druzhba pipeline that passes through Ukraine to Europe from Russia weighed on prices on Wednesday.

Ukraine had halted flows after not receiving a payment from Russian pipeline operator Transneft, which Transneft said had been held up by Western financial sanctions. EU nations hurriedly made sure the payment went through on Wednesday, allowing for a resumption of flows and easing fears that Russia had opened a new front in its energy blackmail against the EU.

US crude oil inventory data was also in focus. The latest weekly report was mixed, with headline crude oil stocks growing by 5.457 million barrels versus an expected 1.0-million-barrel decline. However, gasoline inventories slumped by 4.978 million barrels, much larger than the expected 1.1-million-barrel drop. That eased fears about inflation-induced demand destruction in the US, and likely reflects a recovery in demand with prices having declined in recent weeks.

Further easing concerns about the near-term US demand outlook was a Reuters survey released on Wednesday. The main conclusion was that US oil infrastructure operators expect solid energy demand for the rest of 2022. That helped US natural gas prices rise nearly 5.0% intra-day abck above the $8.0 level. Oil prices, meanwhile, remain in a downtrend that has been in play since mid-June.

Copper Rallies Into Mid-$3.60s, Gold Unable to Hold Above $1,800 Amid Risk-on Flows

Copper prices rallied over 1.0% on Wednesday to hit their highest level since the start of July in the mid-$3.60s, with sentiment bolstered by a sharp decline in the US dollar following softer-than-expected US inflation data. Traders also cited a downside surprise in Chinese consumer and producer price inflation as supportive of prices, given that it hands China’s central bank more leeway to maintain easy financial conditions this year to support growth. China is the world’s largest copper consumer.

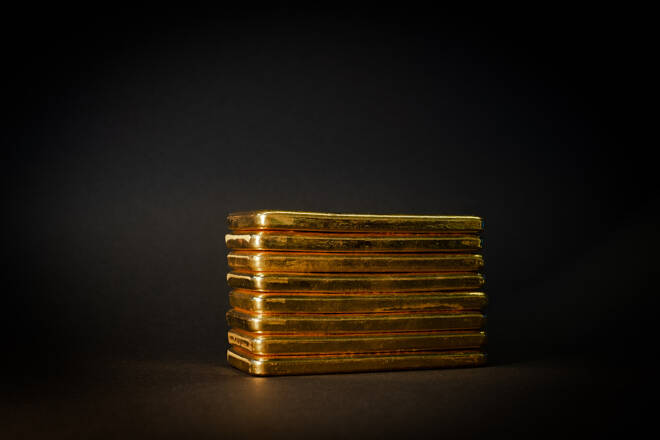

The weak dollar and a sharp decline in US bond yields also helped gold prices surge to fresh one-month highs on Wednesday near $1,808. However, gold prices were unable to hold at earlier session highs and have since pulled back to trade slightly in the red, weighed amid broad upside across risk assets that undermines demand for the precious metal that is viewed as both a safe-haven and inflation hedge.

About the Author

Joel Frankauthor

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018. Joel specialises in the coverage of FX, equity, bond, commodity and crypto markets from both a fundamental and technical perspective.

Advertisement