Advertisement

Advertisement

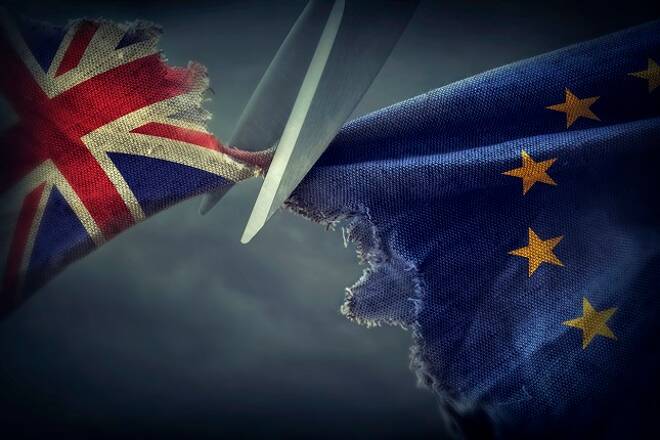

Brexit is the Story of the Day with the Pound in the Spotlight

By:

It’s been a year in the making and, with never a dull moment, Brexit negotiations commence today, leaving the pound on tender hooks as the markets look to

It’s been a year in the making and, with never a dull moment, Brexit negotiations commence today, leaving the pound on tender hooks as the markets look to get a sense of how EU negotiators will position themselves, the tone of the respective sides expected to be their signals of intent over the next 20-odd months.

There are some contentious issues to address, some likely to lead to hot debates, particularly Britain’s Brexit Bill, differing expectations from either side earlier in the year needing to be addressed and quite likely, early on, though following Theresa May’s latest political almost suicide of a snap General Election, the Tories will certainly be wanting to avoid paying out numbers thrown around by the EU in early May, which stood around €100bn.

Chief negotiator Davis had said in response that Britain would not be paying such an amount, which had essentially doubled from earlier estimates of as low as €50bn.

Whether it’s the Brexit bill that comes first or the freedom of movement and protection of EU citizens remains to be seen, but the main issue will be the fact that EU negotiators want to leave trade talks at the end of the laundry list, whilst the British government and Theresa May in particular, had been looking for talks to be held in tandem.

The UK General Election will have left Theresa May and Brexit negotiators floundering in the run up to today’s initial meetings and how Britain will be looking to leave the EU may have also fundamentally have changed, with the DUP having provided support to the Tories to remain in control by way of a minority government.

Uncertainty will be the issue that the pound will likely to face, the question now being whether there will be a hard or soft Brexit, Theresa May having been willing to give up access to the single market with the full knowledge that access would be lost upon taking freedom of movement off the table.

A lack of material stats out of the UK through the week, will leave Brexit in the spotlight and we can expect volatility in the pound to pick up, if that’s at all possible following the gyrations of the last 12-months, as the markets respond to the noise and the tone of the noise coming from Brussels.

At the time of the report, the pound is up 0.10% at $1.2796, though we could see an initial swing upon the opening comments from either side of the table, anything vaguely amicable likely to provide support, but not much considering its just the start.

Elsewhere, Macron’s party victory in the 2nd round of the parliamentary elections provided little support for the EUR, with a poor turnout giving the LREM party 300 seats, fewer than had been anticipated, though still enough to deliver on campaign promises, which are not only pro-EU, but also considered pro-business. Perhaps the greatest concern over the near-term will be the fact that members of the LREM are relative novices in the political arena and as we have seen across the pond, some grey is needed amongst the green to drive change.

As things stand the markets are certainly not too concerned over the LREM’s lack of experience or the start of Brexit negotiations, with European equities kicking off the day in positive territory, following solid gains in the Asian markets, with the Yen easing back 0.24% to ¥111.15 at the time of the report, as appetite for the Dollar builds, news hitting the wires that there is no investigation into U.S President Trump a positive for the Dollar, which comes despite disappointing macroeconomic data out of the U.S last week, including an easing in consumer sentiment.

With a lack of material stats out of the Eurozone or the U.S through the day, the markets will have little to consider that could shift sentiment, while FOMC voting members Kaplan and Evans are scheduled to speak, Kaplan having spoken last week of the need to see a pickup in inflation before supporting a 3rd rate hike for the year, which could weigh on the Dollar should the sentiment be repeated and shared by Evans, the markets having been less convinced than the FED Chair on inflation and the prospects of a final rate hike for the year ahead of the FOMC Press Conference.

We will expect the Dollar to remain range bound ahead of today’s FOMC member commentary, the Dollar Spot Index currently up 0.03% at 97.191, with Kaplan unlikely to provide the Dollar with any support assuming sentiment towards inflation and monetary policy remains unchanged from last Friday, with there being few catalysts to waken the EUR following the parliamentary election result, the EUR down 0.05% at $1.11927 at the time of writing.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement