Advertisement

Advertisement

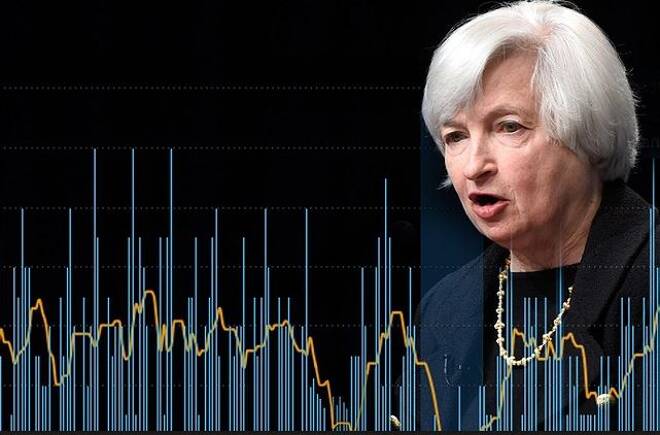

Dollar Rally Stalls on Fed Rate Hike Concerns

By:

Last week’s price action in the Forex markets was primarily dictated by three events – the FOMC meeting minutes, increasing concerns over the presidential

Last week’s price action in the Forex markets was primarily dictated by three events – the FOMC meeting minutes, increasing concerns over the presidential election in France and comments from U.S. Treasury Secretary Steven Mnuchin.

The U.S. Dollar futures contract closed against a basket of currencies at 101.090, up 0.139 or +0.14%, but well off its high at 101.715. The dollar lost ground against the Japanese Yen, Australian Dollar and New Zealand Dollar. The USD/JPY closed at 112.098, down 0.691 or -0.61%. The AUD/USD finished at .7668, up 0.0004 or +0.05% and the NZD/USD ended the week at .7194, up 0.0015 or +0.20%.

The dollar closed mixed against the British Pound and the Euro. The GBP/USD finished the week at 1.2455, up 0.0049 or +0.390% and the EUR/USD closed at 1.0557, down 0.0053 or -0.50%.

Last Wednesday, the U.S. Federal Reserve released the minutes from its January 31 – February 1 monetary policy meeting. The initial interpretation by the cable TV analysts focused on the Fed’s possible reaction to the changes in fiscal spending, tax reform and relaxed regulations by the new Trump administration. They concluded that another rate hike could be right around the corner.

However, the markets interpreted the minutes another way. The drop in U.S. Treasury yields and the subsequent decline in the U.S. Dollar suggested that investors felt the Fed would continue to take a cautious approach to raising rates.

The odds of a rate hike in March and June deteriorated further later in the week after Treasury Secretary Steven Mnuchin said he wants to see “very significant” tax reform passed before Congress’ August recess.

The U.S. Dollar as well as U.S. equity prices and interest rates had been pushed higher this year after President Trump made repeated pledges for tax reform and regulatory cuts since he took office. Mnuchin’s comments suggest that Trump’s plan is now unclear and could prove to be a tough task as U.S. lawmakers will now be forced to work through a complex agenda in a timely manner to satisfy the Fed. This could pressure U.S. interest rates, making the U.S. Dollar a less-desirable investment.

Australian Dollar

The AUD/USD weakened early in the week after the minutes from the February Reserve Bank of Australia monetary policy meeting hinted that the central bank found no urgency to raise rates and that they would remain lower for longer than expected. After a brief sell-off, the Aussie was able to recover into the close for the week due to the Fed minutes and comments from Mnuchin.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement