Advertisement

Advertisement

ECB Publish Banking Data for March to June

By:

The total amount of assets of credit institutions in the euro area increased by EUR 200 billion in the first half of this year, according to the European

The total amount of assets of credit institutions in the euro area increased by EUR 200 billion in the first half of this year, according to the European Central Bank (ECB).

Resources held by credit outlets have now reached EUR 24, 465 billion up to the end of June. Although the number of credit institutions has decreased, by a slender number from 3419 to 3398.

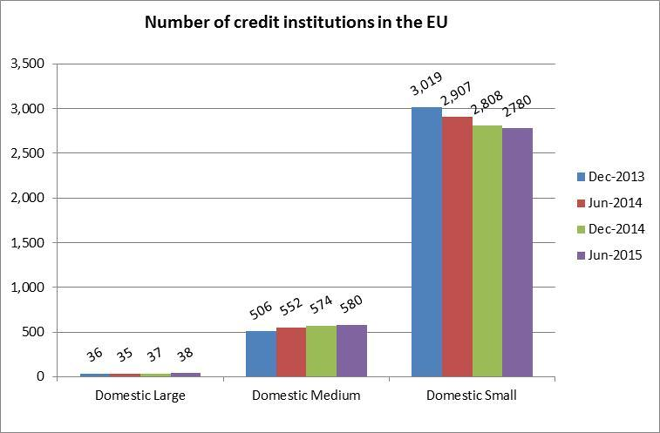

The breakdown of the figures below, reveal that the aggregate of domestic small operations has fallen steadily from December 2013 by 239.

Medium sized credit institutions have bucked that trend, and have increased from 506 to 580.

While the number of domestic large credit establishments has remained more settled, with a difference of just two places. In December 2013 there were 36, compared to 38 in this latest survey.

ECB Data On Banks Moves to a Quarterly Release

The ECB are now releasing consolidated banking data for every quarter of the year. This will increase the frequency of banking information being made readily available from twice a year.

Even though the quarterly data will be a subset of the current level of annual data, the detail will provide a far more clearer picture of the banking industry, due to the scale of the analysis.

The new statistics will include measures of liquidity, funding, and encumbered assets. Indicators on the asset quality have also been replaced by new data on non-performing exposures, as well as key items on forbearance.

UK Financial Regulator to Release HBOS Report

A report into the collapse of HBOS in 2008 is set to be released later today, by the UK’s The Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

They are expected to be critical of the management who were in charge at the time of the fall of the bank, which followed the demise of Lehman Brothers.

The bank was eventually rescued by the Lloyds TSB bank in the UK, although the depth of HBOS’ problems were so severe that the government had to provide a bailout in exchange for a 41% equity stake.

Lloyds also had to receive government capital in the region of £20 billion, most of the public stake in the bank has now been sold.

Euro Gains Ground in the Wake of Federal Reserve Minutes Revealed

The euro has appreciated in value against the US dollar, after minutes were released from the US Federal Reserve’s October meeting, which disclosed their increasing confidence that conditions are being met for a rate rise in December.

Yesterday evening the euro plunged towards to $1.062 mark, before a steep rise to 1.071 in the early hours of this morning. The euro has since slightly descended, as the current rate to the dollar is $1.0703.

Compared to the UK pound, the euro also enjoyed making gains, spiking suddenly to a euro buying £0.7015.

Although the euro has had a chaotic relationship with pound sterling over the past 24 hours.

After 6PM last night the euro steadily rose from just under the £0.7 mark to £0.7005 by midnight, which continued in the early hours of this morning up to £0.701.

The euro also rose to the Chinese Yuan, buying just below RMB6.79 to RMB6.82 this morning.

Against the Japanese Yen, the euro leapt up to over buying Y132 before 6AM this morning, before falling slightly to Y131.7.

About the Author

Peter Tabernerauthor

Advertisement