Advertisement

Advertisement

EUR/CHF – Some Fundamental Truths

Updated: Mar 4, 2019, 13:25 GMT+00:00

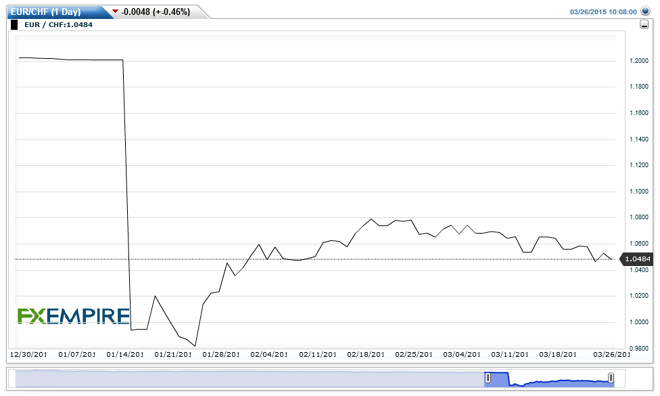

The Swiss National Bank’s (SNB) metal is being tested for the first time since it uncapped the CHF from the Euro in January following Tuesday’s fall below

The Swiss National Bank’s (SNB) metal is being tested for the first time since it uncapped the CHF from the Euro in January following Tuesday’s fall below 1.0450. After climbing back over 1.525 yesterday and starting the day flat, the currency pair is leaning down today. Longer term, all indications are that the SNB will support the currency.

As I write, the 2014 Annual Report of the Swiss National Bank is being released, and the bank has no regrets. The unpegging of the minimum exchange rate of CHF 1.20 to the Euro just ahead of the European Monetary Authority’s quantitative easing was of course no coincidence. Whenever Europe is up to something the markets are not keen on, more capital flows into Switzerland.

The SNB enacted the “extraordinary monetary policy” as European and US monetary policy diverged. Printing even more Swiss francs to buy up even more Euros was bound to affect the competitiveness of Swiss watches, Nespresso and other exports. Meanwhile, the SNB was gobbling up more of the Swiss GDP in the process. The continued balance sheet expansion, says the SNB today, was untenable.

This week’s EUR/CHF decline is the largest dip since the European quantitative easing began two weeks ago. The SNB continues to buy up the Euro with its right hand and sell the overvalued dollar with its left, but it also intends to use a monetary hand to conduct an intervention, “if necessary.”

Swiss Bank on the Offense

The SMB says it spent CHF 25.8 billion on foreign currencies to defend the Eur/CHF peg towards the end of 2014. All indications from this morning’s annual report are that the SMB will keep rates negative and actively ease an overvalued Swiss Franc under the new regime.

On March 19th, the SNB left its benchmark interest rate on cash deposits at -0.75 percent and the target rate for three-month Libor unchanged at between -1.25 percent and -0.25 percent. With political and monetary risk rising in Europe – Russia-Ukraine and Greece – the risk of more capital inflows into the Swiss sanctuary is a threat that would be a negative for its economy, which has managed 2 percent growth in 2014 versus 0.9% for Europe while keeping inflation in check. Switzerland’s GDP forecast for 2015 is 0.9%.

SNB Chairman Thomas Jordan’s statement on the Bank’s attention to “remain active in the foreign exchange market, as necessary” remains on course.

About the Author

Advertisement