Advertisement

Advertisement

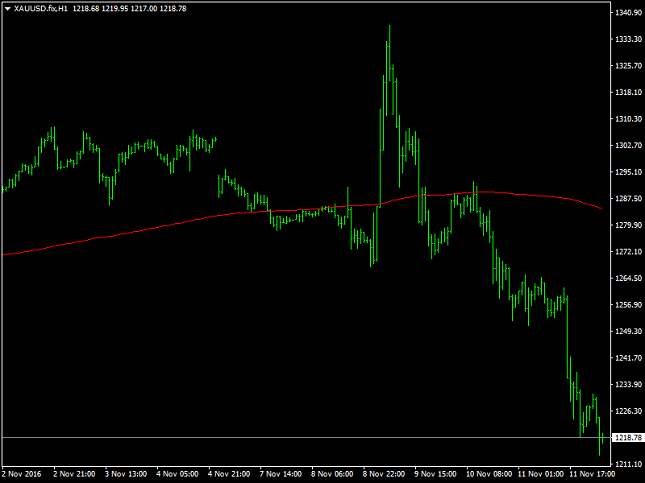

Gold Takes a Tumble

By:

The commodities took a tumble on Friday as the USD gained in strength across the board and the market came to terms with the fact that it didnt have much

The commodities took a tumble on Friday as the USD gained in strength across the board and the market came to terms with the fact that it didnt have much of a choice but to accept Trump as the next US President. The markets did throw a tantrum leading up to the announcement but it realised that it could do little to change things around. It also realised that in the future, such results could become the norm across the developed world.

Though the growing USD strength could be one of the main reasons for the drop in commodity prices, another reason could also be the tough stance that Trump had chosen to take against China during his campaign. He had vowed to bring back jobs to the USA by improving manufacturing within USA and also trying to block outsourcing as much as possible. Both of these could severely affect their trade with China and if Trump does indeed manage to do that, it could affect the Chinese economy which will in turn affect the prices of commodities as China is one of the largest consumers of commodities like steel, copper and gold.

Based on the above, gold prices took a tumble on Friday as the prices broke through the strong support at 1250 and looks set to test the next support at 1200. It sits at 1218 as we write this having dropped by over $50 on Friday and today.

Silver duly followed the example of gold and its prices toppled on Friday as well as it broke back through 18. It had taken a huge effort for silver to climb above 18 in the weeks before but it didnt last long above 18 and duly fell through the support on high USD strength and the general fall in commodity prices all around. It now sits at 17.25 having broken through the 200 DMA and could be looking at further price pressure if the commodity prices continue to fall.

Oil prices stabilised and consolidated through the day on Friday as it was not too affected by the large fall in the prices of other commodities. In fact, it was the instrument that seems to have been least affected by all the market jitters and has basically been consolidating the losses that it had suffered in the week before. The market is waiting for the OPEC meeting to see if the producers can iron out the finer details of the production cut that they had planned in September. Expect some more consolidation and ranging over the next few days.

About the Author

Colin Firstauthor

Colin specializes in developing trading strategies and analyze financial instruments both technically and fundamentally. Colin holds a Bachelor of Engineering From Milwaukee University.

Advertisement