Advertisement

Advertisement

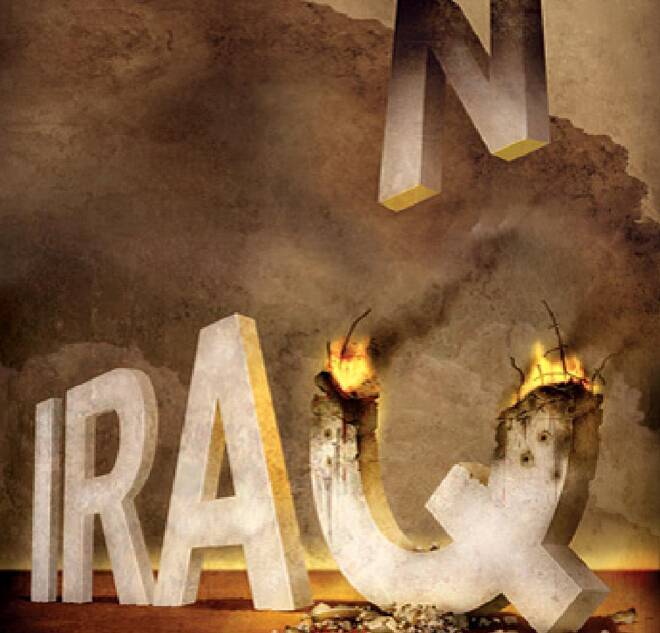

Iraq & Iran Continue To Flood Oil Markets Through 2016

By:

Crude oil rebounded a bit in the Asian session as traders took advantage of low prices to purchase the commodity. The American Petroleum Institute’s

France, U.S. and Russia have stepped up airstrikes in Syria aimed at destroying ISIS following the terrorist group’s attacks in Paris last week. Typically, such events spark fears of supply disruptions and send oil prices soaring. But this time, that didn’t happen. The reality is that there’s actually too much Middle Eastern oil to worry about supply disruptions.

The U.S. more than doubled its imports of oil from Iraq between August and September, according to a Platt’s analysis of U.S. Energy Information Administration statistics. The dramatic increase in Iraqi oil imports is only adding to the already-massive supply glut that has pushed down oil prices. Crude oil prices sank to a four-month low of $40.06 a barrel this week and they’re down 12% in November alone.

U.S. crude oil rose 0.9 percent from a close of $40.67 that was the lowest since Aug. 26. API inventories dropped by 482,000 barrels in the week through Nov. 13, data showed last night. The official EIA report on Wednesday is expected to show supplies expanded by 2 million barrels for an eighth weekly gain.

Another key focus is the release later Wednesday of minutes from last month’s Federal Reserve policy meeting, with dealers looking for hints on whether it will raise interest rates at its gathering next month.

Speculation has mounted in recent weeks that the central bank will pull the trigger following a string of positive US economic figures. A hike would likely boost the dollar and make dollar-priced oil more expensive for those holding weaker units, depressing demand.

Adding to the supply glut woes was a statement Tuesday by Iranian Oil Minister Bijan Zanganeh that Tehran will not negotiate with OPEC over its planned 500,000 barrels per day (bpd) production hike once western sanctions are lifted.

“We will not negotiate with OPEC to increase our production. We will only notify them when we adapt,” he told reporters in Tehran, referring to the Organization of the Petroleum Exporting Countries. Sanctions on Iran are expected to be lifted in early 2016 following a landmark deal in July with major powers to curb the country’s nuclear ambitions. Iran will follow its output rise with an extra one million bpd a year later, Zanganeh said. Analysts have said the excess supplies on global markets that have depressed crude prices for more than a year are likely to stretch well into 2016.

About the Author

Barry Normanauthor

Advertisement